IESO is targeting six areas of NERC’s reliability standards in its 2026 compliance program, largely continuing a focus on issues it has prioritized since 2023.

The 2026 Market Assessment and Compliance Division (MACD) Reliability Standards Compliance Monitoring Plan will prioritize:

-

- Critical Infrastructure Protection (CIP)

- Inadequate Models Impacting Planning and Operations (MOD/PRC)

- Gaps in Program Execution (FAC)

- Automatic Underfrequency Load Shedding (PRC)

- Inverter-Based Resources (PRC), and

- Extreme Weather Response (EOP)

MACD says its priorities consider the reliability standards’ applicability to Ontario; the assessed reliability risks and compliance history of each standard; power system infrastructure and demand changes; and emerging threats and vulnerabilities.

“While market participants are required to comply with and be able to demonstrate compliance with all applicable reliability standards at all times, MACD puts a more significant focus on a subset of these market rules and reliability standards that are more explicitly monitored for compliance in a given year,” IESO said.

The MACD conducts scheduled and unscheduled audits, in addition to accepting self-reports and self-certifications.

MACD selects the subject of scheduled audits based on “both market participant specific information and Ontario-specific risks.” Subjects are provided at least 90 days’ notice before the start of scheduled audits. MACD also may conduct unscheduled audits “potentially with very little or no notice,” it said.

NERC Concerns

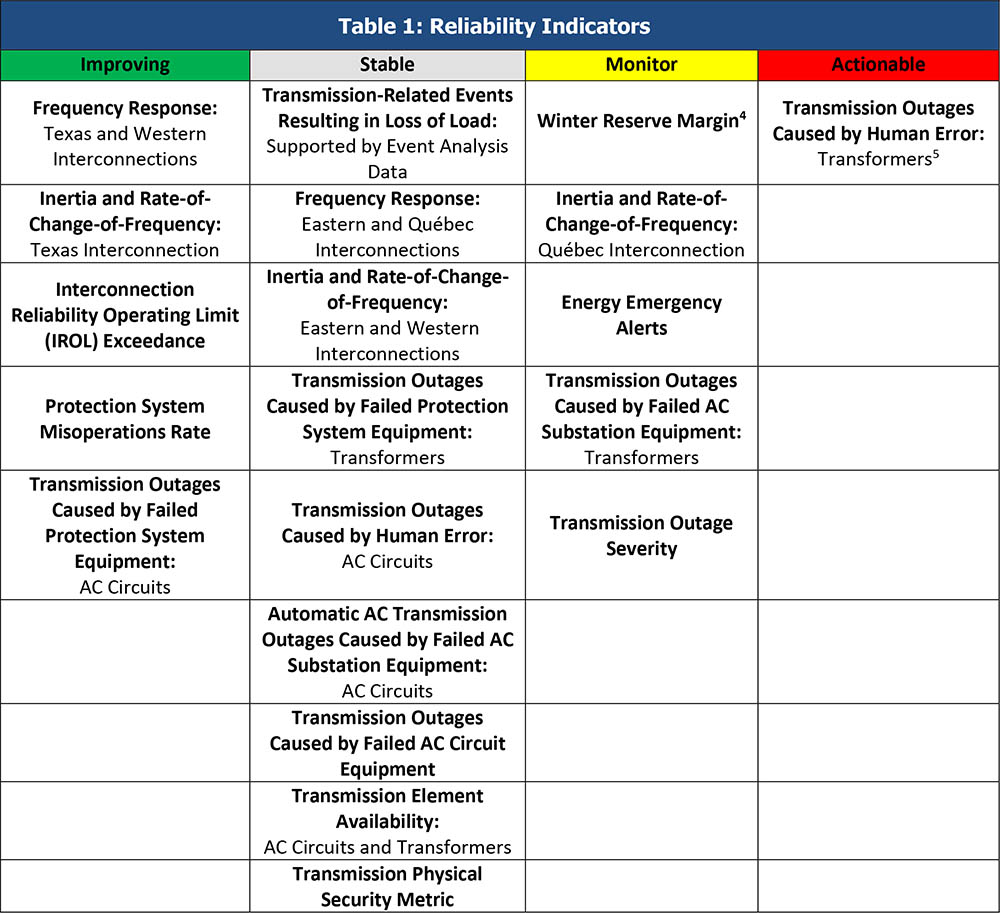

In its 2025 State of Reliability Report, NERC said key performance metrics such as frequency response and misoperation rates continued to improve or remain stable.

It said weather continued to be responsible for the most severe outages in 2024, citing two significant winter storms and five major hurricanes. It noted an improvement in winter performance, with no operator-initiated load sheds, in part due to efforts to improve generator performance during extreme cold.

The report says large data centers pose a “significant near-term reliability challenge” because they are growing faster than generation and transmission infrastructure. It said more accurate models of data centers’ operational characteristics are needed because of their “voltage sensitivity and rapidly changing, often unpredictable, power usage.”

NERC also noted improvements in frequency response in regions with high concentrations of battery energy storage systems, but said some inverter-based resources “continue to unexpectedly reduce output following disturbances that generators have historically been expected to ride through.”

MACD Findings

MACD’s Sanctions and Negotiated Settlements notices include violations of market rules, as well as several cases involving NERC and Northeast Power Coordinating Council reliability standards.

In 2022, IESO reached a $1.67 million settlement with Ontario Power Generation and a $1 million agreement with Hydro One Networks for failing to properly plan a maintenance outage at the Darlington Nuclear Generating Station. IESO alleged that OPG and Hydro One failed to recognize the purpose and limits of electrical protective relay schemes. In one instance, equipment at the Bowmanville Switching Station operated without this scheme for approximately five months without incident, which IESO concluded “gave rise to a significant market and electrical reliability concern with a low probability of occurrence.”

In 2023, it reached a $327,000 settlement with Kirkland Lake Power Corp. and a $12,500 agreement with Iroquois Falls Power Corp. IESO said Kirkland Lake failed to maintain evidence that it maintained its equipment as required and, in another event, incorrectly adjusted the underfrequency trip settings on certain electromechanical relays. Iroquois Falls lacked evidence that it conducted the required annual vegetation inspection of a transmission line in 2018.

GenSet Resource Management agreed in 2023 to pay $500,000 for its failure to comply with dispatch instructions for operating reserves between 2013 and 2019, which IESO said posed a reliability risk.