Last November, I wrote about the insanity of green hydrogen electricity. And I’ll return to that below.

But I’d like to start with green hydrogen generally, focusing on the first of DOE’s funded “hydrogen hubs” located in — where else? California!

From the PR materials, we can piece together a somber tale. Let’s start.

When is a Hub not a Hub?

The term “hub” is a misnomer. There will be 10 or more hydrogen production sites (at renewable energy facilities), with hydrogen transported to four ports, 60 truck/bus fueling stations, two power plants, etc. There does not appear to be a central location that would receive and store hydrogen for transshipment to end-use locations.

The funding statute, the Bipartisan Infrastructure Law, defines a hydrogen hub as a network of hydrogen producers and hydrogen consumers “located in close proximity.” Instead, with this “hub,” hydrogen production sites span most of the state, and hydrogen consumers in San Diego and Lodi are 473 miles apart.

So much for Congress’ “close proximity” requirement.

Making Global Warming Worse

This hydrogen “hub” is going to make global warming worse. Here’s why.

This project is going to use electricity from 10 or more renewable production sites across California to make hydrogen, and then store and transport the hydrogen to, among other consumers, two or more power plants. In my prior column, I showed how the losses in converting renewable energy to hydrogen, storing and transporting the hydrogen, and then converting the stored medium back into electricity, would take 7 MWh of green electricity at the source to end up with 1 MWh of green electricity delivered to end-use consumers.

And that’s what will happen here. Every 7 MWh of renewable generation at production sites that otherwise would have been delivered directly to the grid, displacing natural gas generation, instead will be diverted to this hydrogen “hub,” ultimately becoming 1 MWh of renewable generation delivered to the grid. So, every metric ton of carbon emissions avoided at the point of consumption will result in 7 metric tons of incremental carbon emissions from non-displaced natural gas generation.

Does that make any sense to anybody?

Cost of Carbon Emission Reduction

This hydrogen “hub” is a $12.6 billion project. Let’s ballpark a 10% annual revenue requirement for return of (depreciation) and return on capital, so $1.26 billion annually. DOE says this hydrogen hub will reduce carbon emissions by “2 million metric tons per year.”

That can’t be so for the reason given in the prior section, but giving DOE the benefit of the doubt, if we do the math, that’s a cost of $630 per ton of carbon emission reduction.

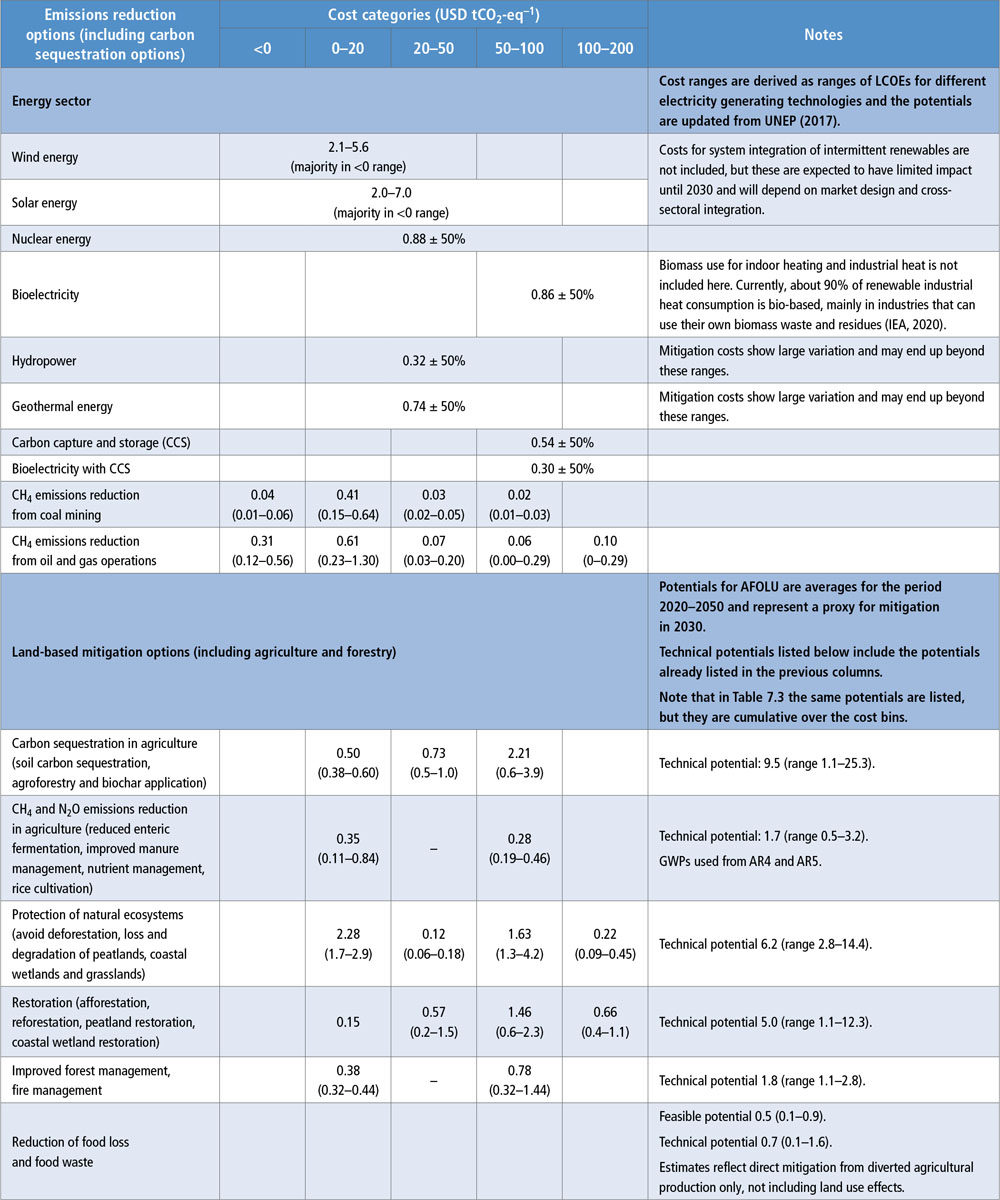

That cost is a multiple of the per ton cost of dozens of other carbon mitigation options, including 10 in the energy sector alone, as this IPCC table (see page 1,254, Table 12.3, Energy Sector portion) shows. All listed options are $200/ton cost or less.

Which begs the question, why spend many billions on a hydrogen “hub” that, even assuming DOE’s figures, still costs more than a multiple of myriad other carbon mitigation options?

Job Creation

DOE claims this hydrogen hub will create 90,000 permanent jobs. This appears to be typical sleight of hand that ignores the fact that what taxpayers must pay for this program will reduce their disposable income, thereby reducing their spending and thereby reducing the jobs their spending would otherwise support. And those would be jobs providing products and services that people actually choose to pay for, instead of jobs artificially created by government agencies using taxpayer money.

Let’s take an example: DOE says the hub will fund 5,000 hydrogen trucks and 1,000 hydrogen buses. But the truck drivers and bus drivers driving new hydrogen trucks and buses instead would have kept driving diesel/gas trucks and buses. No new jobs.

Water

Have I mentioned all the water that will be needed for the electrolysis to produce hydrogen (9 kg of ultrapure water for every 1 kg of hydrogen)? This in a state not known for having a lot of spare water. Just sayin’.

Backup for Well Water Pump

Speaking of water, DOE says it “will use hydrogen to provide backup power to community well water pumps to ensure clean drinking water during power outages.”

This use of taxpayer dollars is wrong for at least three reasons. First, the recipient, the Rincon Band of Luiseno Indians, is a small tribe (about 500 members) that owns Harrah’s Resort Southern California — an enormous hotel/casino/events center. This tribe does not need subsidies from the rest of us.

Second, the tribe’s water well pump already has backup generation in the form of a 130-kW diesel generator. DOE’s implication that the tribe would get backup generation it doesn’t already have is wrong.

Third, the tribe already is using taxpayer funds for a new solar/battery system. Is the plan to substitute some sort of hydrogen system for this solar/battery system? Or perhaps have three systems (in addition to the grid): the diesel generator, the solar/battery system and the hydrogen system? Yikes.

OK I’ll stop the hydrogen rant here.

P.S. Re. last column’s P.P.S. about “(What’s So Funny ‘Bout) Peace, Love, and Understanding,” I came across this live Elvis Costello cover where the Bangles show up. It seems like it’s over at four minutes but somehow rocks on. And oh yeah, the Boss with Bon Jovi. And Sheryl Crow covers it not too shabby. And Bob Geldof — thank you for Live Aid! — gives a reading that explains it before killing it. Thank you again Bob Geldof!

Columnist Steve Huntoon, principal of Energy Counsel LLP, and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.