FERC and NERC will conduct yet another inquiry into cold weather grid failures after Duke Energy (NYSE:DUK) and the Tennessee Valley Authority cut power to consumers because of insufficient generation during December’s winter storm.

FERC announced Dec. 28 it would conduct the joint investigation with NERC and its regional entities after millions of customers were left without power following the storm’s snow, frigid temperatures and high winds.

“Although most of these outages were due to weather impacts on electric distribution facilities operated by local utilities, utilities in parts of the Southeast were forced to engage in rolling blackouts and the bulk power system in other regions was significantly stressed,” the agencies said.

FERC Chair Richard Glick said the behavior of the bulk power system during the storm shows that the BPS “is critical to public safety and health.”

NERC CEO Jim Robb noted that December’s storm was the fifth major winter event in the last 11 years.

“In addition to the load shedding in Tennessee and the Carolinas, multiple energy emergencies were declared and new demand records were set across the continent. And this was in the early weeks of a projected ‘mild’ winter,” Robb said. “This storm underscores the increasing frequency of significant extreme weather events … and underscores the need for the electric sector to change its planning scenarios and preparations for extreme events.”

NERC’s 2022-2023 Winter Reliability Assessment, released in November, warned that while most areas were prepared for average winter temperatures, multiple regions — including North and South Carolina — were at risk of insufficient electric supplies during peak winter conditions. (See NERC Warns Winter Margins Tight in Multiple Regions.)

Outside of the Southeast, the winter storm prompted conservation calls and emergency alerts in the Eastern Interconnection, while ERCOT and SPP joined TVA in setting new demand records. In PJM, where load hit 135.3 GW on the evening of Dec. 23, calls for conservation limited the peak to less than 129 GW on Dec. 24.

Some 500,000 customers who lost power during the storm across New York had their service restored as of Dec. 28, the New York Public Service Commission reported. The Buffalo area was pummeled by more than four feet of snow and winds as high as 70 miles per hour; more than three dozen deaths were attributed to the storm. Gov. Kathy Hochul called it the “most devastating storm in Buffalo’s long storied history.”

Southeast Struggles

Twitter users complained about being asked to conserve energy while corporate offices — including those of Duke Energy in Charlotte — remained fully lit. | Michael Konen via Twitter

Twitter users complained about being asked to conserve energy while corporate offices — including those of Duke Energy in Charlotte — remained fully lit. | Michael Konen via TwitterDuke said in a release that it “was forced to interrupt service” to around half a million customers in North and South Carolina the evening of Friday, Dec. 23, and Christmas Eve morning, because of both increased demand from the below-freezing temperatures and “a shortage of available power in the Southeast.” Separately, a high-wind event Dec. 24 left about 40,000 customers without power.

Duke spokesperson Jeff Brooks told WRAL News in Raleigh that generator failures also played a part, along with challenges “in our ability to secure additional power from outside of our service area” because the extreme cold affected neighboring utilities as well.

While the utility reported it was back to normal operations in both states by Dec. 26, its customers — which Duke had thanked for helping reduce demand through voluntary conservation efforts — were less than pleased. Several Twitter users noted that major buildings in downtown Charlotte — including Duke’s own headquarters — appeared fully lit despite pleas for conservation. Others complained they had gotten no notice before Duke cut their power, even those relying on electricity for medical devices.

North Carolina Governor Roy Cooper tweeted that he was “grateful for those who conserved energy” but also “deeply concerned” about the alleged lack of notice for rolling blackouts. He said he had “asked Duke for a complete report on what went wrong and for changes to be made.” The utility is also scheduled to brief the North Carolina Utilities Commission on the outages at a meeting on Tuesday.

TVA Takes ‘Full Responsibility’ for Outages

Meanwhile, TVA said in a statement on Wednesday that it would “take full responsibility for the impact we had on our customers” and promised a “thorough review” of the holiday outages.

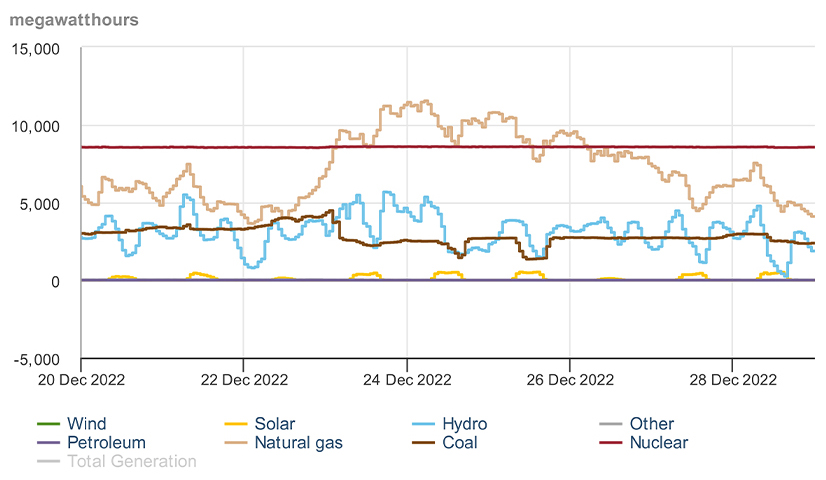

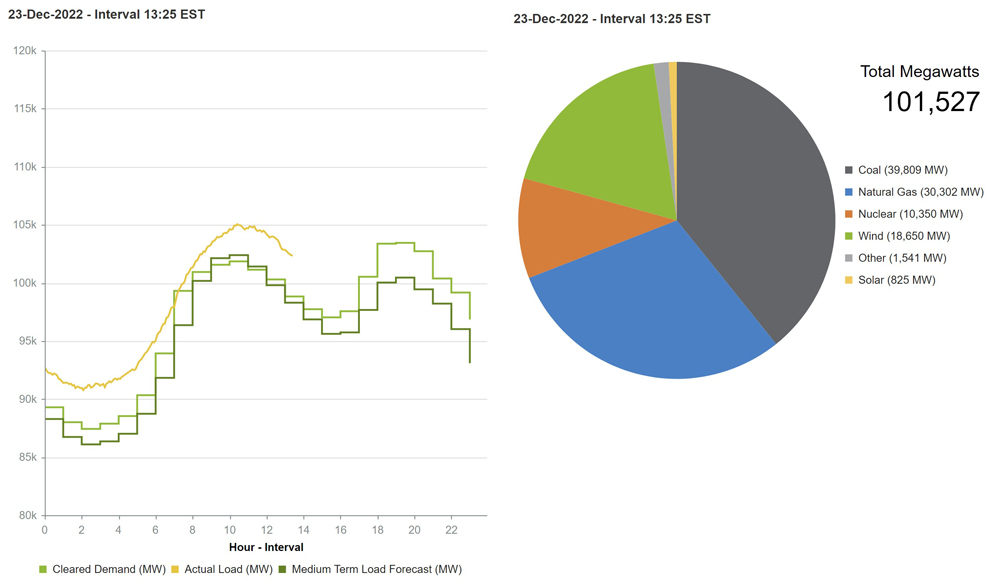

The utility acknowledged that it had ordered local power companies to reduce consumption by 5% on Dec. 23 and again on Dec. 24 by up to 10%. The Dec. 23 curtailment lasted two hours and 15 minutes, while the Christmas Eve cuts lasted more than five hours. TVA said that during the 24-hour period that began on Dec. 23, it “supplied more power than at any other time in its nearly 90-year history,” providing 740 GWh. The utility set its highest winter peak power demand, at 33.4 GW, at 7 p.m. the same day.

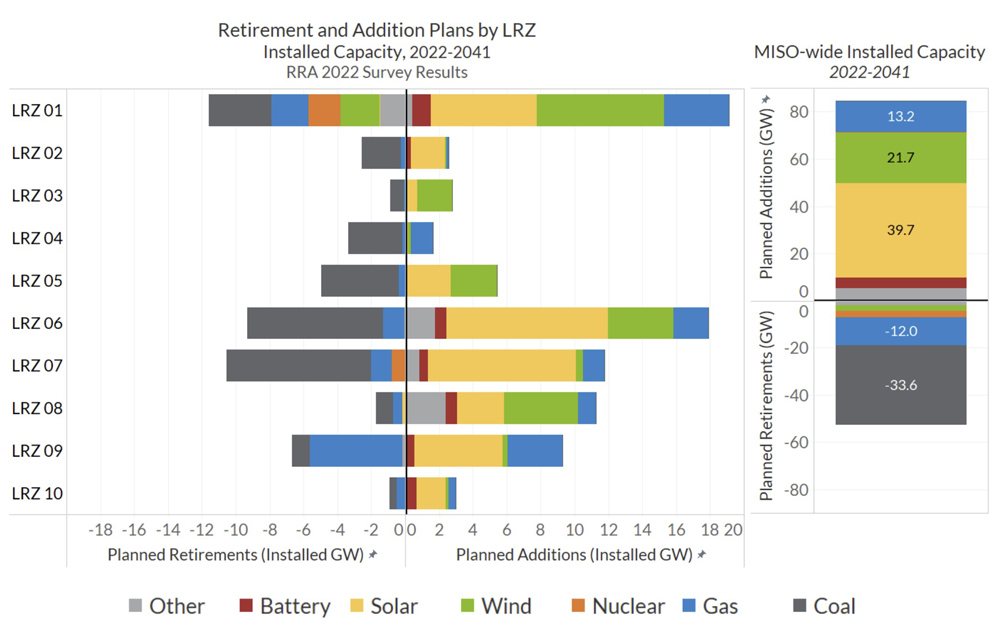

Dec. 23 also marked “the first time in TVA’s 90-year history that we’ve had to direct targeted load curtailments due to extreme power demand.” While TVA did not mention generation outages in its statements, data from the Energy Information Administration showed that output from coal plants in Tennessee dropped significantly during the same period, from 4.5 GW the morning of Dec. 23 to a low of 1.4 GW Christmas afternoon.

As with the Duke outages, considerable criticism ensued in TVA’s service territory over the lack of warning. Nashville Mayor John Cooper said on Twitter that Nashville Electric Service “received only an eight-minute warning from TVA” on Dec. 23 about the coming blackouts. Fifty Nashville residents were without service at one point, according to local media, along with 226,000 in Memphis, where Mayor Jim Strickland said the utility was “not as reliable as they said they were.”

DOE Grants ERCOT’s Emergency Request

Battling some of the same problems that almost brought down its grid during February 2021 — thermal outages and derates, forecasts that underestimated load, gas supply issues — ERCOT went so far as to ask for help from the federal government as temperatures dipped into single digits in Texas’ northern regions.

New ERCOT CEO Pablo Vegas sent a letter to U.S Energy Secretary Jennifer Granholm on Dec. 23 requesting permission to ignore air quality or other permit limitations and run the grid’s power plants at their maximum output levels during Energy Emergency Alerts level 2 (load management procedures in effect) or EEA3 (firm load interruption is imminent or in progress) conditions. Vegas cited “natural gas delivery limitations” in saying the grid operator might not be able to avoid curtailing firm load.

He said about 11 GW of thermal generation were offline or derated, compared to 4 GW of wind and 1.7 GW of solar resources. Vegas said ERCOT “understands the importance of the environmental permit limits.”

“However, in ERCOT’s judgment, the loss of power to homes and local businesses in the areas that may be affected by curtailments presents a far greater risk to public health and safety than the temporary exceedances of those permit limits that would be allowed under the requested order,” Vegas wrote.

The Department of Energy agreed an emergency existed and quickly granted the grid operator’s request that same day (202-22-3).

“The DOE order was a tool to have at our ready should we need it, which we did not,” ERCOT spokesperson Trudi Webster said in an emailed statement. “ERCOT had sufficient generation to meet demand … and had additional tools left to deploy should additional generation been needed.”

Staff used all available import capacity on the DC ties, deployed additional capacity enrolled in emergency response service, suspended charging by energy storage resources, and directed load resources providing responsive reserve service to curtail demand. Online reserves exceeded 11 GW at times.

ERCOT’s average hourly demand peaked at 73.96 GW during the morning of Dec. 23, smashing a six-year-old December record of 57.9 GW.

The grid operator’s final seasonal resource adequacy assessment had projected demand to peak this winter at 67.4 GW, although models upped that to nearly 71 GW as the storm approached. (See ERCOT Says ‘Sufficient’ Capacity to Meet Winter Demand.)

Austin-based Stoic Energy consultant Doug Lewin said poorly insulated homes led to the “crazy high” demand. He pointed out that FERC and NERC identified energy-efficient homes as one of the fixes after the ERCOT grid came within minutes of collapsing during the 2021 February winter storm. “Lots more work to do,” he said.

Demand officially peaked at 69.8 GW during the 2021 storm, but Texas A&M University’s Texas Center for Climate Studies has said demand would have reached 82 GW had not more than 50 GW of generation been unavailable.

At one point on Dec. 23, more than 77,000 Texas customers were without power, according to PowerOutage.us. The cold front’s wind gusts reached 40 miles per hour at times and accounted for most of the localized outages. They also resulted in wind production that provided nearly half of ERCOT’s fuel mix.

Average prices that were still settling below -$1.00/MWh as late as 5 p.m. Dec. 22 went as high as $4,084.62/MWh during the interval ending at 7 a.m. Dec. 23. By 9:15 that night, prices dropped back into the triple-digit range, with a high of nearly $140/MWh on Dec. 24.

SPP Calls EEAs, Sets Demand Mark

SPP set a new mark for winter demand when load peaked at 47.1 GW on Dec. 22, smashing the previous record of 43.7 GW set during the February 2021 storm.

The persistent cold led to tightening reliability conditions in SPP’s 14-state Midwestern footprint and forced it to declare two EEA1s (all available generation resources in use) on Dec. 23 that lasted for more than four hours.

The grid operator called the first EEA1 at 8:27 a.m. CT and ended it at 10:00 a.m. SPP issued the second EEA1 at 5:20 p.m. as load exceeded staff’s forecast and generation dropped off heading into the evening peak. The RTO called off the alert at 8:20 p.m.

SPP also extended a previously issued conservative operations advisory for its Eastern Interconnection balancing authority footprint from 12 a.m. CT Dec. 25 to noon Dec. 25.

ISO-NE Handles Christmas Eve Capacity Deficiency

An unexpected generator outage and a reduction in imports from other regions led to a somewhat tense Christmas Eve for ISO-NE.

ISO-NE headquarters in Holyoke, Mass. | ISO-NE

ISO-NE headquarters in Holyoke, Mass. | ISO-NEThe New England grid operator was forced into a series of actions to respond to the Dec. 24 capacity deficiency, going into its Operating Procedure 4 for the first time since Labor Day 2018.

The problems weren’t closely connected to the worst-case scenario that ISO-NE has laid out in recent years, where an extended cold snap challenges energy supply. The weather wasn’t especially cold on the Saturday, and demand was only very slightly above its predicted level at the peak hour.

Instead, it was unplanned outages and reductions at multiple generators, including an unidentified “large generating station” that pushed the grid operator into action. ISO-NE spokesperson Matt Kakley said the grid operator won’t release information on which specific units were knocked out or reduced.

In total for the day, New England unexpectedly lost 2,150 MW of generation and neighboring regions under-delivered energy by about 100 MW compared to the grid operator’s morning plans — and 1,100 MW less than what had cleared in the day-ahead market.

According to ISO-NE’s report on the deficiency, it first declared an abnormal conditions alert at 4 p.m. Dec. 24., with escalating actions coming subsequently until peak load had passed and the conditions eased by 6:30.

While the system was briefly strained, ISO-NE said, “only a small amount of day ahead cleared export transactions were curtailed and no emergency purchases were scheduled.”

Along with the warnings of an imminent energy shortage, the skyrocketing real-time wholesale prices (to over $2,000/MWh) at the peak hour raised eyebrows in New England, with one commenter noting that in the ISO-NE app, the whole region was colored a bright Christmas red.

MISO South Dodges Emergency

MISO managed to avoid an emergency in its South region despite issuing a maximum generation warning during the fierce cold blast Dec. 23.

MISO issued a maximum generation warning around 9 a.m. ET for the South as the storm intensified into a bomb cyclone and lifted the warning before 1 p.m. MISO said its South region was facing higher than forecasted load and significant generation outages.

MISO South remained in conservative operations mode and under a cold weather alert until Dec. 26. The storm also forced MISO Midwest into conservative operations overnight into Dec. 24. MISO’s conservative operations instructions request members defer or cancel generation or transmission maintenance and return facilities to service as soon as possible.

The grid operator issued a cold weather alert for its South region ahead of the frigid weather on Dec. 20. On Dec. 22, central Mississippi and Arkansas recorded low temperatures around 10 degrees Fahrenheit.

Entergy Texas said its crews restored damage from “strong winds and gusts that swept across Southeast Texas” on Dec. 22.