The ERCOT grid, tweaked since the disaster of 2021, twice proved its mettle during 2022, meeting record demand during the summer’s sizzling early months and then again during the pre-Christmas winter storm.

That gave Texans a chance to chortle when another state institution, Southwest Airlines, ran into difficulties over the holiday. It also gave Texas Gov. Greg Abbott an opportunity to pause his daily tweets about the southern border and praise ERCOT for not failing during two “extremely cold nights.”

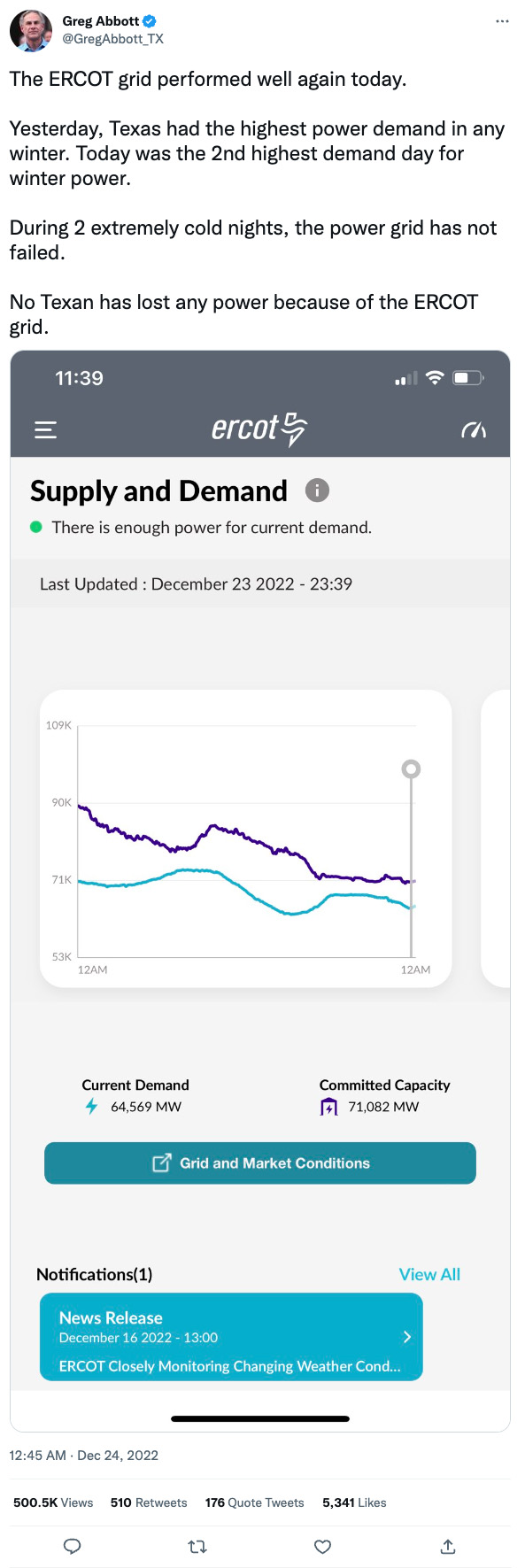

“No Texan has lost any power because of the ERCOT grid,” Abbott tweeted.

Gov. Greg Abbott tweets during the winter storm. | Greg Abbott via Twitter

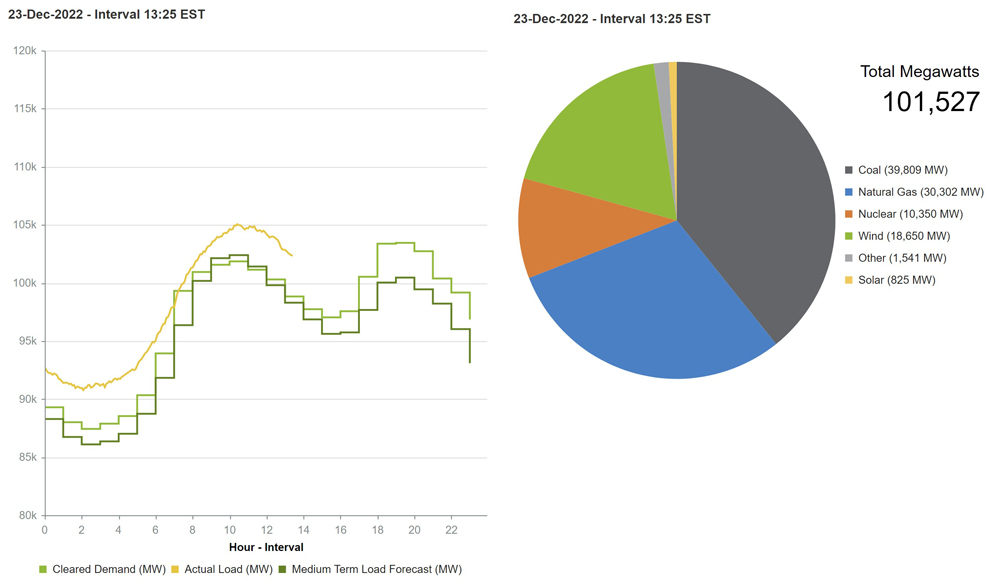

Gov. Greg Abbott tweets during the winter storm. | Greg Abbott via TwitterWhile there were localized outages at the distribution level, the grid held firm and set a new winter demand peak of 73.96 GW on Dec. 23 that was a 27.7% increase from the previous mark. Demand officially peaked at 69.8 GW during the February 2021 winter storm, but Texas A&M University’s Texas Center for Climate Studies has said demand would have reached 82 GW had not more than 50 GW of generation been unavailable.

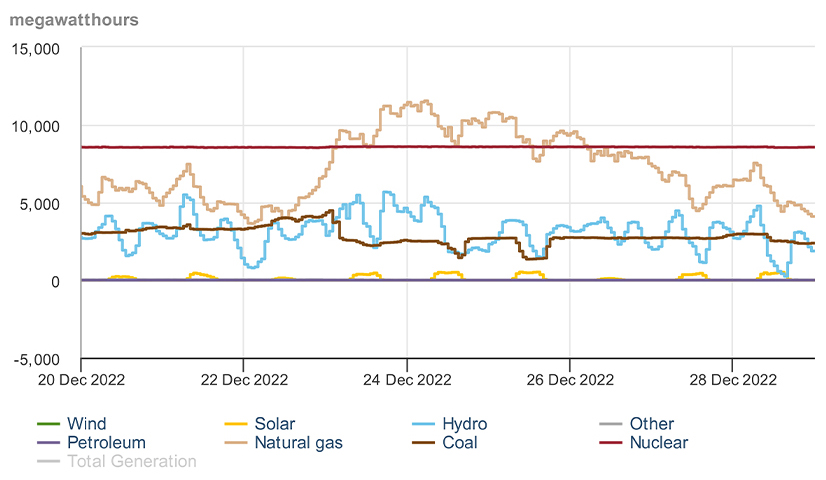

ERCOT experienced many of the same issues that plagued it during the deadly 2021 storm, as chronicled by Stoic Energy principle Doug Lewin. The grid operator’s staff underestimated demand during the storm by 4 to 6 GW. Thermal plants again had problems staying on, with almost half the coal fleet offline Dec. 23 and gas plants again facing “fuel limitations” despite the lack of snow and ice.

At times, as much as 12 GW of generation was offline. ERCOT asked for, and received, the Department of Energy’s permission to ignore air quality and other permit limitations and run the grid’s power plants at their maximum output levels in the event of emergency conditions.

Fortunately for ERCOT, the storm, delivering single-digit temperatures but dry conditions, hit right before a holiday weekend, when demand tends to drop. Clear skies and wind gusts in the 40-mph range generated half of energy production at times.

Attention now turns to the Texas State Legislature, which opens its 88th session on Jan. 10 and where lawmakers are waiting to pass judgment on the Public Utility Commission’s proposed market redesign.

Following months of public work sessions, closed-door discussions and a consultant firm’s analysis of six different options, PUC staff urged the commission to adopt a performance credit mechanism (PCM). In public hearings, legislators joined some ERCOT stakeholders in criticizing the concept for being overly complicated, lacking a reliability standard and doing little to attract new baseload generation to Texas. (See Stakeholders Respond to ERCOT Market’s Proposed Redesign.)

The PCM would require load-serving entities to buy performance-based credits from generation resources in a voluntary forward market. The credits are awarded to resources through a retrospective settlement process based on availability during the 30 hours of highest risk, according to their load-ratio shares during those same periods. (See Proposed ERCOT Market Redesigns ‘Capacity-ish’ to Some.)

While generators largely support the PCM and its emphasis on dispatchability, the renewable sector and consumer groups argue it would harm further development of low-cost wind and solar energy.

ClearView Energy Partners, a D.C.-based independent research firm, said in a report that while the PCM is designed to be “resource agnostic,” it would “seem to financially benefit dispatchable conventional resources.” ClearView did allow that some renewables coupled with energy storage could also earn some performance credits.

New ERCOT CEO Pablo Vegas staked out staff’s support of the PCM during the December meeting of the grid operator’s Board of Directors. He said the concept will be critical to “incentivize and retain dispatchable generation” and to meet increased reliability goals.

“Based on our analysis, the performance credit mechanism option strikes a good middle ground that maintains the best parts of the energy-only market while providing new incentives to improve reliability and put steel in the ground,” Vegas said, noting several generators have told lawmakers that the PCM is one of the better options and will result in expected new generation investment.

The Texas Competitive Power Advocates (TCPA), a trade association representing generators, wholesale marketers and retail providers, has said it is prepared to add more than 4.5 GW of additional thermal generation to ERCOT if the PCM is adopted under the “right framework.”

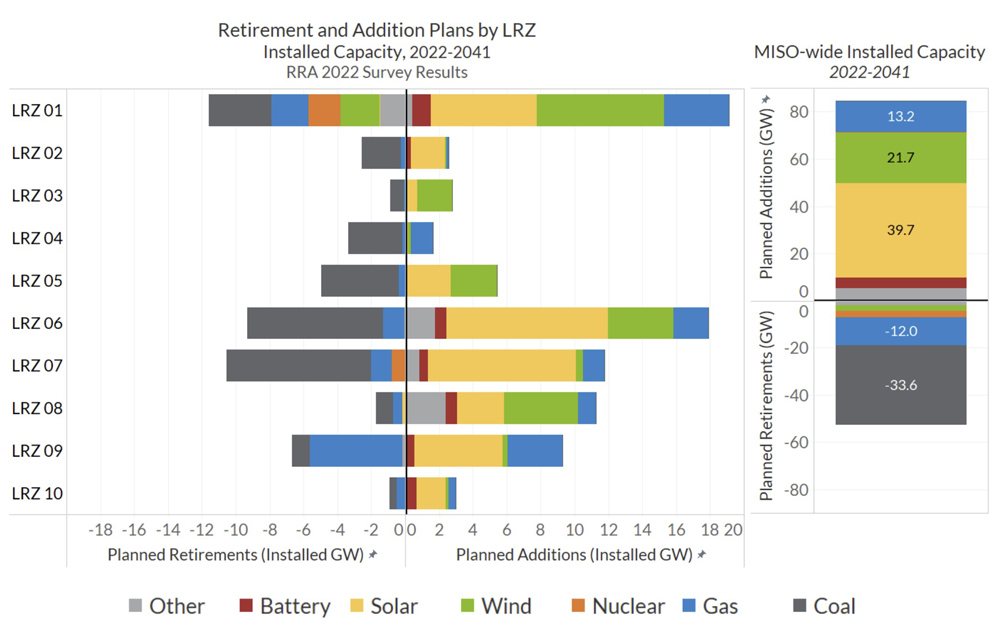

The need to meet growing demand is obvious. ERCOT set an all-time demand peak of 80.04 GW in July, one of the summer’s more than three dozen demand records. Seven years ago, the grid almost peaked at 70 GW. Given ERCOT’s measure that 1 MW can power about 200 Texas homes during peak demand periods, that would mean about 2.1 million homes have been added to the grid during that time.

Vegas and PUC Chair Peter Lake have taken to using Corpus Christi — the eighth largest city in the state at 317,863 residents, according to the 2020 census — as an example of the state’s exploding growth. They say Texas is adding that many people every year, placing additional pressure on developing dispatchable generation resources.

“One of our clear goals this legislative session is to help members understand the resource adequacy challenges that Texas faces in the future,” Vegas said. “The dispatchable gap that is growing between ever increasing load and dispatchable generation is a real issue and is vital. Addressing this issue with clarity will give investors the certainty that they need to build dispatchable generation of Texas needs.”

Lawmakers are expected to be open to the message with the gas industry’s prominence in the state. (See PUC, ERCOT Face More Heat from Texas Lawmakers.)

“Ultimately, we think legislators and/or regulators could approve a new reliability mechanism next year that benefits gas-fired plants, potentially at the expense of renewable resources,” ClearView said. “This could slow deployment of solar and wind in the largest U.S. renewables market.”

Dispatchable generation such as this gas-fired facility are seen as key by some to ERCOT’s market redesign. | WattBridge

Dispatchable generation such as this gas-fired facility are seen as key by some to ERCOT’s market redesign. | WattBridgeThe PUC has scheduled a work session for Jan. 12 to discuss the design proposals and stakeholder feedback. A vote is not expected on the proposals during that meeting, but a plan is expected to be adopted later in the month and then passed on to the legislature. The commission also has open meetings scheduled for Jan. 19 and 26.

ERCOT has already made several changes as a result of laws passed during the 2021 session. Generation and transmission facilities have been required to weatherize, and the grid operator’s staff have been conducting compliance inspections, something that didn’t happen after rolling blackouts during a 2011 freeze.

Generators have been required to keep additional fuel sources on site in case of emergencies, and several ancillary services have been added to the energy-only market. At the same time, ERCOT’s price cap was nearly halved, from $9,000/MWh to $5,000/MWh.

During a summer of tight margins and several conservation calls, ERCOT’s conservative operations posture relied on reserves and reliability unit commitments to keep thousands of megawatts in reserve. The grid operator’s market monitor has said that has added hundreds of millions in costs as electricity costs rose more than 70% year-over-year in June.

In December, ERCOT announced a new voluntary curtailment program for crypto miners and other large flexible loads, effective with the new year. It later expanded the program’s scope, designed to reduce power use scare periods, to include loads qualified to provide ancillary services or emergency response service but that don’t have an active obligation to provide those services. (See ERCOT Opens Curtailment Program to Crypto Load.)