Planning Committee

Stakeholders Endorse 2022 Reserve Requirement Study Results

The PJM Planning Committee on Oct. 4 voted by acclamation to endorse the results of the 2022 Reserve Requirement Study, which would reset the forecast pool requirement (FPR) and installed reserve margin (IRM) for the next three years and determines a recommendation for 2026/27. It would also set a winter weekly reserve target (WWRT) for the upcoming season.

The recommended IRM remains at its current 14.9% for 2023/24 before falling to 14.8% the following year and declining to 14.7% for 2025/26 and the next year. Last year’s study recommended a similar decline, though moved up a year in advance. (See “Reserve Requirement Study Recommends Raising IRM and FPR,” PJM MRC/MC Briefs: Sept. 21, 2022.)

Driven largely by scarce projected capacity available for import during peak season, the recommended FPR for 2023/24 increases under the study, going from 1.0901 in last year’s analysis to 1.093 in this year’s. That moves downward to 1.0926 in 2024/25 and falls to 1.0918 for the following two years.

The study recommends a 27% WWRT during the peak winter month of January, 23% for February — the next highest consumption winter month — and 21% in December. The figure is used to aid PJM in planning outages.

The IRM and FPR are set to be reviewed by the Markets and Reliability and Members committees in October through November and by the Board of Managers in December. The WWRT is scheduled to be voted on by the Operating Committee in November.

Load Forecast Model Recommendations Discussed

PJM Senior Analyst Andrew Gledhill reviewed the recommendations under consideration for the development of a new load forecast model.

The recommendations are derived from a report produced by the consulting firm Itron, which was contracted in April to perform a model review. They include:

- replacing annual/quarterly end-use indices with the use of monthly/daily indices, which would allow for the use of more recent data that are more representative of current patterns. Monthly models would also result in heating and cooling figures that are more reflective of the amount of weather variation in each month.

- continuing with the current weather simulation approach, but with a shorter historical lookback period of 20 years and seven rotations; 27 years and 13 rotations are currently used.

- replacing daily models with hourly load models, which would allow for more flexibility to incorporate future trends and technology, particularly the impact of solar and electric vehicles.

- adjusting loads for new technologies through the simulation process, reflecting current knowledge about how behind-the-meter solar and EVs behave and layering those understandings into simulations.

- incorporating climate change into long-term forecasts and evaluating long-term temperature trends for each planning zone.

Gledhill said PJM is in the process of evaluating the first four recommendations for the 2023 load forecast and will report its progress to the Load Analysis Subcommittee. The fifth recommendation is expected to take additional thought and engagement with stakeholders, with a tentative plan to incorporate it into the 2024 load forecast.

Poll Opened to Gather Support for Packages on CIR for ELCC Resources

The PC is holding a nonbinding poll to gauge support for the six proposals currently on the table to address capacity interconnection rights (CIRs) for effective load-carrying capability (ELCC) resources. Opened after the committee’s meeting, the online poll closes Tuesday at noon.

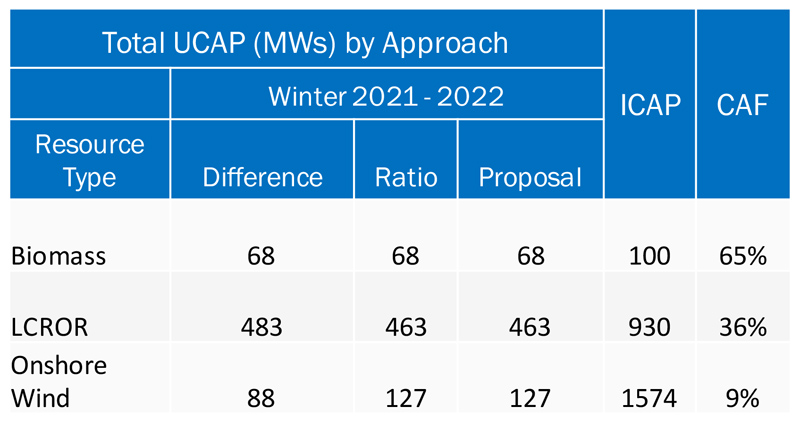

The poll asks respondents to say whether they can support each of the packages and, if not, to indicate which of the design components they are against. The packages are composed of five overall components: CIR request policy; CIR verification, testing and retention policy; CIRs in ELCC methodology and accredited unforced capacity calculations; implantation and effective dates; and transition mechanisms.

The sponsors of the packages outlined the changes that the proposals have undergone over the past few months and discussed the effects each would have.

Tom Hoatson, director of Mid-Atlantic policy for LS Power, said his company’s package could continue to change depending on the results of the poll, particularly its CIR request policy, which he said was written to achieve a consensus in prior special sessions and relies upon the same language as one of the PJM packages. Stakeholders questioned what the impact would be should a generator request a higher CIR level than it can deliver under that language.

Responding to questions about the impact of the packages on the cost and timing of the RTO’s interconnection queue restructuring effort, PJM’s Jonathan Kern said the proposals that incorporate higher CIRs into the mix would have an impact on the queue.

Economist Roy Shanker said that any time the order of the queue is changed and applications are moved ahead of each other, the cost allocation changes alongside it, and those who are “jumped over” will face increased costs. The current structure being considered would result in approximately 7,200 to 7,300 MW of projects being given priority status, which would result in an estimated $2 billion cost for applicants in the fast track and Transition Cycle 1, he said. The costs remain unknown for those in Transition Cycle 2, but Shanker said they could potentially face billions in increased costs.

“As long as you don’t change that order, you don’t change that cost,” he said.

Transmission Expansion Advisory Committee

$13M in Tx Projects Discussed

At the Transmission Expansion Advisory Committee meeting that followed the PC’s meeting, several transmission owners presented supplemental projects for the PJM Regional Transmission Expansion Plan.

Baltimore Gas and Electric is planning the replacement of its High Ridge 230-1 transformer, installed in 1960 and in deteriorating condition, at a $7.4 million cost.

American Electric Power meanwhile has several facilities operating on a former practice of applying a double multiplier in the ratings of facilities that connect in a configuration where flow could split between two paths in a station. The company is in the process of applying single-multiplier ratings to all its facilities, but four were flagged in PJM’s 2025 RTEP analysis that could result in violations of NERC reliability standards.

The work would include replacing breakers and associated equipment at the 765/345-kV Marysville transformer, 345/138-kV East Lima transformer, 345-kV Jefferson-Clifty Creek line and 138-kV Olive-New Carlisle line at a $5.92 million cost.