IESO is considering a broader range of long-duration energy storage technologies in its upcoming long lead-time procurement but will not include hydroelectric redevelopments, officials told stakeholders at an engagement session Nov. 19.

ISO officials also said they are considering changes to a termination provision and additional flexibility on outages.

IESO created the long lead-time procurement (LLT RFP) because energy storage resources such as compressed air and pumped hydro require longer planning cycles than the four-year lead times for resources offering in the pending Long Term 2 (LT2) procurement. The ISO plans to seek 600 to 800 MW of capacity and up to 1 TWh of energy from resources requiring at least five years of lead time in a solicitation expected about Q4 2026.

The energy stream of the LLT RFP will be open to new build hydroelectric facilities with a nameplate capacity of at least 1 MW that do not include pumped storage. LDES projects will be eligible for the capacity stream.

Eligible Technologies

In response to stakeholder requests for greater flexibility, IESO said it is considering increasing the limit on Class II LDES technologies to 200 MW from 100 MW and lowering the minimum to 10 MW from 50 MW.

Stakeholders said the proposed 50-MW minimum project size and a 100-MW cap would limit the procurement to only one or two LDES projects. Stakeholders proposed minimum project sizes as low as 1 MW.

“Most likely, with the current setup, we would be procuring only one project,” acknowledged IESO’s Jasdeep Kahlon. “However, we maintain that the need for a cap is required to limit risk related to these less proven technologies.”

Kahlon said the ISO doesn’t see the benefit of dropping the minimum size below 10 MW, “as the minimum size requirement is intended to ensure participation from commercial-scale projects and not intended to procure less proven pilot-scale technologies.”

Hydro Redevelopments

The ISO also rejected participation by hydro redevelopments, saying it has received limited information about potential projects and noting that “historical redevelopment timelines are highly variable,” with some taking up to six years and others being completed in less than four years.

It also said there is “little evidence to justify” the 40-year contracts planned for the LLT procurement for hydro redevelopments and said such projects should seek 20-year contracts under the LT2 RFP scheduled for early 2026. (See IESO Officials Deny Favoring Gas Resources in Upcoming Procurement.)

Optional Termination

At an engagement session in October, the ISO said it would seek to reduce risks in the procurement by reserving the right to reject proposals that are too expensive and allowing the ISO and generation developers to cancel deals in the first few years. (See IESO Seeks to Manage Risks in Long Lead-time Procurement.)

The ISO said the termination option could be exercised by IESO or the project developer in the first two or three years after the contract date.

Stakeholders said the termination option would increase developers’ risk and make financing more expensive, while reducing participation levels. They also said it could discourage participation by Indigenous communities that “typically invest in projects with a high likelihood of reaching commercial operation and generating long-term revenue.”

The ISO said it would specify the circumstances that could result in a termination — such as failure to meet key milestones or obtain permits — and the date on which the optional termination right would lapse. It also is considering the termination payment that would apply when IESO or the supplier terminates and whether suppliers that terminate projects would be eligible for future procurements.

Reserve Prices

IESO proposed to use reserve prices — a confidential price threshold — to ensure it doesn’t pay too much for energy or capacity in the solicitation. The ISO said the thresholds will be based in part on prices in the first window of the LT2 procurement and differences in the obligations of LT2 and LLT resources.

Many stakeholders opposed the proposal, saying prices from recent IESO procurements are not a good comparison due to the lifespans of the technologies procured.

The ISO said reserve prices will ensure the procurement is cost effective and broadens Ontario’s supply mix while addressing the uncertainty of developing LLT resources. “The potential benefits associated with long lead-time resources, along with the longer lifetimes, will be considered in the determination of a reserve price,” it said.

Outages

IESO said it is developing a proposal to provide additional flexibility for “mid-term extended outages” and aligning them with annual planned maintenance outage requirements for LDES technologies. IESO had proposed a single outage of up to 12 months after the 20th anniversary of the contract. (See IESO Ups Capacity Target for Long Lead-Time Resources.)

Stakeholders told IESO it should consider permitting suppliers to take outages beginning after year 10 of the contract term and allow them to take multiple outages adding up to 12 months. Some said technologies using mechanical storage, such as compressed air energy storage (CAES) and pumped hydro, should be able to take an annual planned outage for up to 10 business days, similar to that for natural gas generators under the LT2(c-1) contract.

Early In-service Provisions

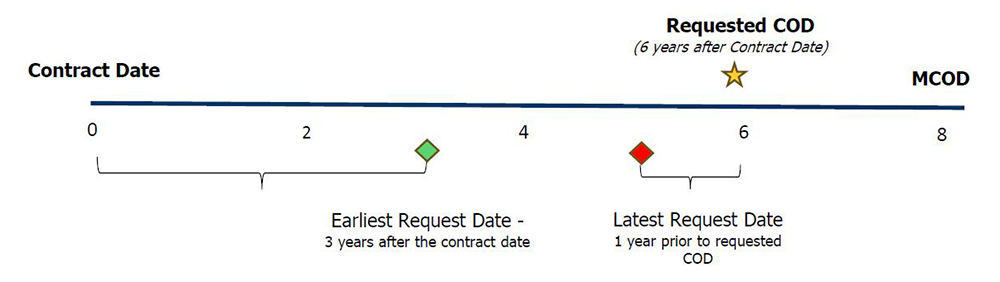

ISO officials said they may allow developers to begin commercial operation before the planned commercial operation date (COD). The request would have to be filed no earlier than three years after the contract date and at least one year before the expected COD. Commercial operation could be no earlier than five years after the contract date.

IESO approval would depend on deliverability and system needs (e.g., Annual Planning Outlooks showing a need for energy arising earlier than capacity).

Environmental Approvals and Permitting

Because some LDES technologies are new to Ontario, the ISO said developers should consult early with the Ministry of Environment, Conservation and Parks regarding the environmental assessments and permitting requirements that will apply.

Team Member Experience

Kahlon said IESO is considering providing more flexibility to the team member experience requirements.

Under IESO’s proposal, hydro developers must have at least two team members with experience with a hydro facility with a nameplate capacity of at least 1 MW that has achieved commercial operation in Canada or the U.S. within the past 15 years.

Stakeholders said the proposed requirement may create obstacles for mature resource types such as pumped hydro because no such projects have been commissioned within the past 15 years.

“For pumped storage projects, the requirement to have developed a ‘same technology’ project should include conventional hydroelectric facilities, as pumped storage is a direct variant of hydroelectric generation and the relevant development expertise is transferable,” Andrew Thiele, senior director policy and government affairs for Energy Storage Canada, said in written feedback.

Jim Beamish, head of planning and analysis for Access Capital Corp., said requirements should be functional, as they were in the early 2000s when Ontario started procuring wind and solar generation.

“I recognize your concerns,” Beamish said, “but the ISO really needs to look back at that and say, ‘Well, what didn’t work?’ Because … there have been no CAES projects that reached commercialization in in the last 15 years.”

“The intent here is definitely not to limit participation through team member experience,” responded IESO’s Danielle D’Souza. “It’s really meant to just ensure that we have the best chance of these projects getting across the finish line.”

Municipal Support Resolutions

Paul Ernsting, of Peterborough Utilities, said it may be challenging for developers to obtain required support resolutions from municipalities because of 2026 elections.

“If you’ve got less than three-quarters of council coming back, then that’s a lame duck period. They don’t do any decision-making during that period,” he said.

“You’ve got your elections happening Oct. 26. Once everyone’s elected, they don’t start meeting until mid- to late November at the earliest. … That can be a tight timeline for this procurement, as well as for LT2 window two.”

D’Souza welcomed the feedback. “We’ve heard that it’s very different from municipality to municipality,” she said.

Next Steps

The IESO asked stakeholders to comment on the LLT RFP by Dec. 3 using the feedback form posted on the engagement webpage.