NERC officials appeared before an Organization of MISO States board meeting in an attempt to quell regulators’ discontent with MISO’s “high-risk” label in the 2025 Long-Term Reliability Assessment.

“I think we understand your concerns,” said NERC CEO James Robb, who referred to “anxiety” around the exclusion of MISO’s interconnection queue fast track in the LTRA. He said the LTRA “is not a prediction in any way.”

“It’s a risk assessment,” he told regulatory staff members at a Feb. 9 Organization of MISO States board meeting.

NERC found that by winter 2028/29, MISO would struggle with reliability under normal conditions. Some state regulators bristled at the designation and criticized the assessment for not including MISO’s expedited generator interconnection process and the projects in it.

Regulators also said NERC’s conclusion essentially ignores that most MISO states must plan resources with accordance with state law and that MISO measures its reserve margins differently from in NERC assumptions. (See MISO States Dispute ‘High Risk’ Designation from NERC.)

Robb said this year’s findings in the LTRA are a product of load growing faster than resources can be added or steadily dropping resource inventories. He said NERC is seeing “more and more” regions move into elevated reliability risk. “It’s been growing and growing in severity,” Robb said.

But over the years, he said, areas designated as “normal” in the LTRA have experienced emergency shortages while areas labeled “high risk” have pulled through difficult episodes.

Robb said the emergence of winter-peaking circumstances in the LTRA is due to an increasing deployment of solar generation suppressing the summer peak.

“Solar’s a hell of a resource. It doesn’t do a lot for you in winter,” he said.

He also said NERC has in recent years found more limits overall with generators and resources that have become especially susceptible in winter.

John Moura, NERC director of reliability assessment and system analysis, explained the data collection deadline that left off generation proposals in MISO’s interconnection queue fast lane. He said NERC must cut data collection off in summer to release the assessment. The deadline helps NERC understand which resources are firm and deliverable by transmission, Moura said.

Moura said time and again, NERC sees the most certain, “Tier 1” generation projects fail to meet stated in-service dates.

“So, expecting 20 GW and getting 10 GW. We really are seeing half the resources come in on time,” Moura said. “It’s not an indictment; it’s not a prediction. We trying to showcase the risk … to stimulate the action needed.”

Moura said the industry is learning that the “individual, isolated planning that got us a long way is breaking down a bit.” He said neighboring regions need to understand one another’s systems more. NERC strives to provide a “bedrock,” he said, by using consistent assumptions.

Wisconsin Public Service Commissioner Marcus Hawkins cautioned NERC officials about assuming all new load at speed is gospel. He pointed out that the utilities reporting load additions stand to benefit from the boosted demand. He told NERC to be careful “if all upstream assumptions are from people with vested interests.”

Michigan Public Service Commission Chair Dan Scripps said it feels like states in an RTO get “picked on” because even though most states in MISO are vertically integrated and have the same state-level mandates to maintain resource adequacy, they nevertheless are coded red.

South Dakota Public Utilities Commissioner Chris Nelson asked NERC officials if they think the LTRA is read as a prediction by the public.

Robb said it “certainly seems” the LTRA is construed that way “despite our best efforts.” He added NERC hopes to “raise the flag” about getting more infrastructure built, and “not the old-fashioned way.” He said grid expansion is going to take changes to permitting and siting processes.

MISO Senior Manager of Market Design Neil Shah said at a Feb. 10 Entergy Regional State Committee meeting that MISO is in contact with NERC to try to improve assumptions used in the LTRA.

Shah said including the generator interconnection express lane likely would “close the gap” in the NERC report. However, he said uncertainty remains due to the potential for more large loads claiming spots on the grid.

MISO expects the first projects from its expedited generator queue to come online in 2028, Shah said. Beyond that, Shah said “MISO is projecting higher rate of new resource additions in 2026” than have historically come online annually from 2022 to 2025.

“It incorporates a lot of things that we don’t necessarily agree with,” Bill Booth, a consultant to the Mississippi Public Service Commission, said of the assessment. He added that in addition to the expedited queue omission, NERC didn’t factor in the trio of coal plants in MISO kept online via the U.S. Department of Energy’s emergency orders under the Federal Power Act’s Section 202(c).

MISO Promotes Stakeholder Involvement in Reworking NERC RA Standard

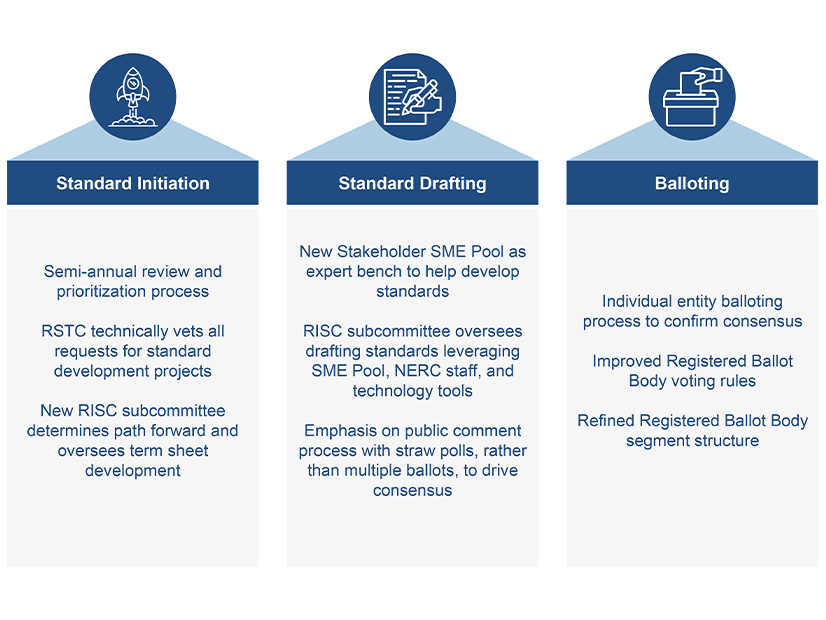

Meanwhile, MISO has encouraged its stakeholders to participate in NERC’s development of a new energy assurance draft standard after it scrapped the first draft.

MISO’s Zhaoxia Xie said at the January Reliability Subcommittee meeting that stakeholders should get involved. The reliability corporation’s first draft of a proposed planning energy assurance standard failed to get enough votes in support to advance. NERC’s standard drafting team is assessing next steps and is planning a technical workshop Feb. 17 and meetups Feb. 18 and 19 to start revisions.

MISO regulators panned NERC’s first attempt at a new resource adequacy standard over 2025. They said it would have infringed on states’ grid planning authority. (See MISO States Call NERC’s Planned RA Standard Inappropriate.)

NERC’s original design would have had planning coordinators conducting their own Long-Term Energy Reliability Assessments using an unserved energy basis and reporting the results to NERC. Resource planners and transmission planners then would have to prove they developed corrective action plans — enforced by the ERO — to address “unacceptable” levels of reliability risks in long-term assessments.

“MISO is being open-minded and working with NERC to move along this effort,” Xie said.

Minnesota Power’s Tom Butz said it seems the NERC effort is entering “uncharted territory” and that a draft standard could be an opportunity to view system reliability in a new way. Butz asked that the RASC plan for “hands-on interplay” with the NERC docket as it’s drafted.

Xie said MISO doesn’t plan to schedule stakeholder discussion on the standard “because the project is not moving as fast” as originally thought.

MISO staff also said the RTO already covers or exceeds what the standard originally intended to include; they said even the draft standard wouldn’t push its modeling into unfamiliar ground.