Oregon regulators have approved PacifiCorp’s plans to issue a request for proposals for renewable resources — with a condition that the company accept bids for resources with conditional firm transmission.

The Oregon Public Utility Commission voted 3-0 on Aug. 26 to approve the RFP. The solicitation is for power purchase or energy storage agreements of five to 20 years, for resources that are online by the end of 2029.

The proposed RFP sparked a debate between PacifiCorp and stakeholder groups about whether resources dependent on conditional firm transmission should be eligible to bid.

PacifiCorp has never allowed resources with conditional firm transmission to participate in its RFPs, Rick Link, PacifiCorp’s senior vice president for resource planning and procurement, told the commission.

“It’s not called ‘firm’ for a reason,” Link told the commission.

The circumstances that may trigger transmission curtailment are unique to each conditional firm agreement, PacifiCorp said in an OPUC filing. And the fact that resource contracts may last as long as 20 years increases the uncertainty.

“These unique conditions for curtailment introduce imprudent and unnecessary risk in planning for reliable operations,” the filing said.

The Northwest & Intermountain Power Producers Coalition (NIPPC) and Renewable Northwest argued in favor of allowing bidders that plan to use conditional firm transmission.

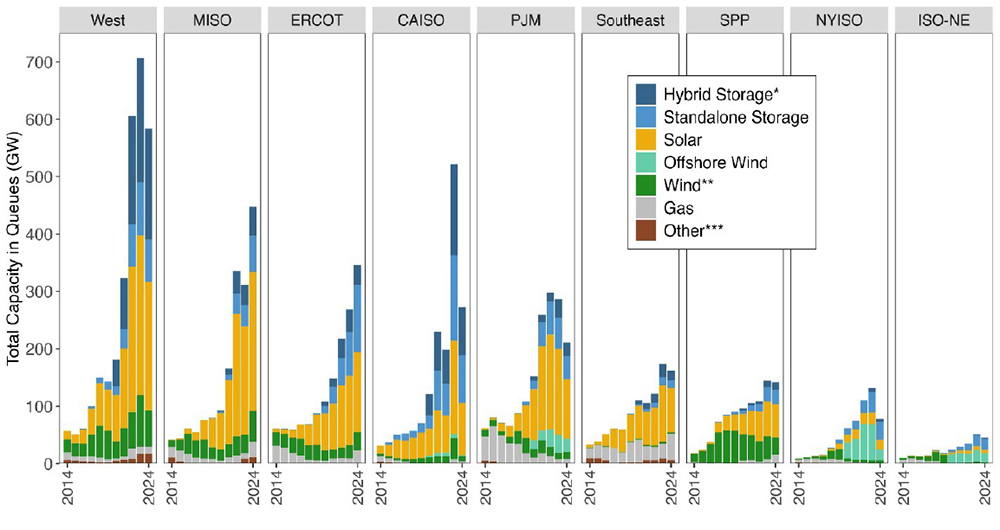

“This could substantially increase the bid pool given the sizable queue of projects waiting to be granted long-term firm service at BPA,” Renewable Northwest said.

According to NIPPC, Bonneville Power Administration (BPA) offers two types of conditional firm transmission. In one option, BPA may curtail service up to a set number of hours. Alternatively, service curtailment may occur under specific system conditions.

But in reality, BPA rarely curtails conditional firm service, NIPPC said.

In addition, NIPPC said, BPA will lift the conditions on its conditional firm service when transmission expansion projects are completed.

“PacifiCorp, along with other utilities like Portland General Electric Company and Avista, need to be more proactive and innovative in the increasing[ly] transmission constrained world,” NIPPC said, while noting that PGE has allowed conditional firm transmission service in recent RFPs.

Growing Constraints

In approving a 2022 RFP, the Oregon commission asked PacifiCorp to analyze potential ways to include conditional firm bids in its next RFP.

“Increasing constraints on the transmission system, particularly on the west side of the PacifiCorp system, make it important to begin to more seriously consider alternative transmission products that may deliver a significant portion of the value that some resources offer the system,” the commission wrote in the 2022 order.

But PacifiCorp remained opposed to including conditional firm transmission for resources in its 2025 RFP.

The company said that under rules for the Western Power Pool (WPP) Reserve Sharing Group, any resource procured that uses conditional firm transmission would require PacifiCorp to hold 100% contingency reserves. PacifiCorp wouldn’t have access to WPP reserves in the event of the loss or curtailment of conditional firm transmission.

The Reserve Sharing Program is different from WPP’s Western Resource Adequacy Program (WRAP).

And conditions leading to curtailments are more likely when market demand is highest, PacifiCorp said, “which may necessitate the procurement of unspecified market purchases at an elevated price and with the associated assignment of emissions.”

Despite PacifiCorp’s arguments, the commission ordered the company to accept bids using conditional firm bridge, number of hours or system conditions transmission service in its 2025 RFP. The company will work with an independent evaluator to develop a framework for evaluating those bids alongside firm transmission bids.

2nd Phase Possible

The commission’s order leaves the door open for a second phase of the RFP, perhaps in 2026, in the event that questions are resolved around the Boardman-to-Hemingway (B2H) transmission line.

B2H, a partnership between PacifiCorp and Idaho Power, is fully permitted. Idaho Power said on its website that it hopes to break ground on the project in 2025, with an in-service date of 2027. B2H is a 500-kV line that will run about 290 miles from the Longhorn substation near Boardman, Ore., to the Hemingway substation in Idaho.

PacifiCorp included B2H in the preferred portfolio of its 2021 integrated resource plan. At the time, the company expected it would be able to redirect transmission rights with BPA to have a point of receipt at Longhorn, allowing B2H to serve existing load in its West balancing authority area (PACW), according to a report from OPUC staff.

But in 2022, BPA said the redirect requests would need to be evaluated in a cluster study process that had been paused.

PacifiCorp expects B2H to be completed, “but at this time, it is not known when the redirect requests [with BPA] will be granted, when redirect requests might be effective and how much it might cost.”

PacifiCorp noted that its RFP doesn’t prohibit bids from developers whose resources would use the B2H transmission line.

Decarbonization Goals

The 2025 RFP follows a commission finding that PacifiCorp’s 2023 Clean Energy Plan didn’t show continual progress toward House Bill 2021 goals. HB 2021 requires the state’s large investor-owned utilities to decarbonize their retail electricity sales by 2040.

PacifiCorp’s RFP doesn’t state the exact amount of resources that will be procured. The company will decide during the scoring process which resource quantities are most cost-effective.

But the company notes that its 2025 integrated resource plan calls for 1,570 MW of utility-scale solar, 1,400 MW of utility-scale wind resources and 320 MW of small-scale solar resources by the end of 2029, along with 781 MW of energy storage of various durations.

An earlier version of the RFP included a requirement that resources be deliverable to Oregon load. PacifiCorp said that was needed due to transmission constraints. But the company agreed to remove that requirement and will instead allow delivery to its six-state system.