Families struggling with painfully high power bills are making headlines across the country. An Oakland resident racked up $1,400 of power bills while taking unpaid leave to deal with her high-risk pregnancy. A New York parent’s power was shut off for six months after her power bill tripled at the same time she lost her job. A disabled Florida senior was forced to choose between paying for his medication or his power bill.

Residential electricity bills have moved from being background noise in discussions about resource adequacy, decarbonization and transmission expansion to being the loudest political and business risk. Households do not experience the grid through integrated resource plans or RTO stakeholder processes. They experience it once a month, in a single number.

If that number rises too far, too fast, the system’s social license begins to erode.

Policy Costs Embedded in Retail Rates

Retail bills now carry policy objectives that extend well beyond the marginal cost of electricity.

Clean energy mandates, public purpose programs, low-income assistance mechanisms and legacy regulatory decisions are embedded in rate design. Many jurisdictions rely on non-bypassable charges and fixed cost recovery mechanisms that have grown as a share of total bills.

For customers, these line items are opaque. When they see an increase in their monthly bill, they do not parse which portion reflects transmission upgrades, wildfire mitigation, renewable integration or administrative overhead. They see only a cost-of-living increase.

And they react accordingly.

If the issue already is in the headlines, imagine the backlash utilities, regulators and politicians will face if prices continue to outpace inflation: ICF estimates residential electricity rates could rise 15 to 40% over the next five years and double by 2050.

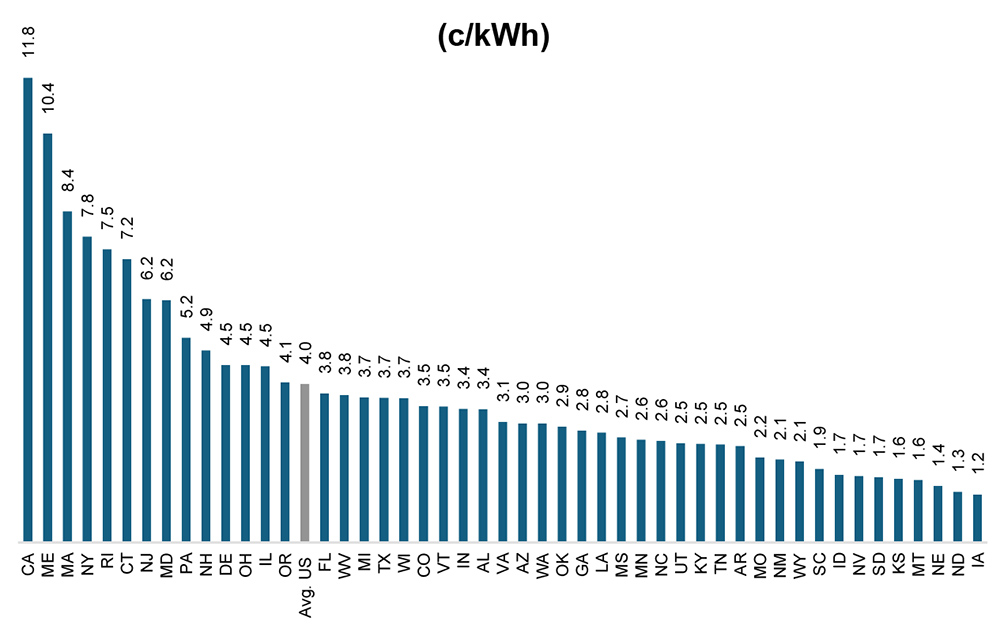

National Trends Versus Regional Realities

While rates are up across the board, the realities are more subtle. For every headline-grabbing story about families struggling with power price increases, there are counter stories that never make the news.

“Prevailing narratives that there is a broad national trend of rapidly rising electricity rates are inaccurate or incomplete,” Charles River Associates warned, in its Retail Rate Trend analysis prepared for Edison Electric Institute and published in February.

In the Northeast, for example, retail rates are more susceptible to increases in wholesale electricity prices because utilities there do not own generation, whereas in California, wildfire costs and related mitigation have been the key drivers.

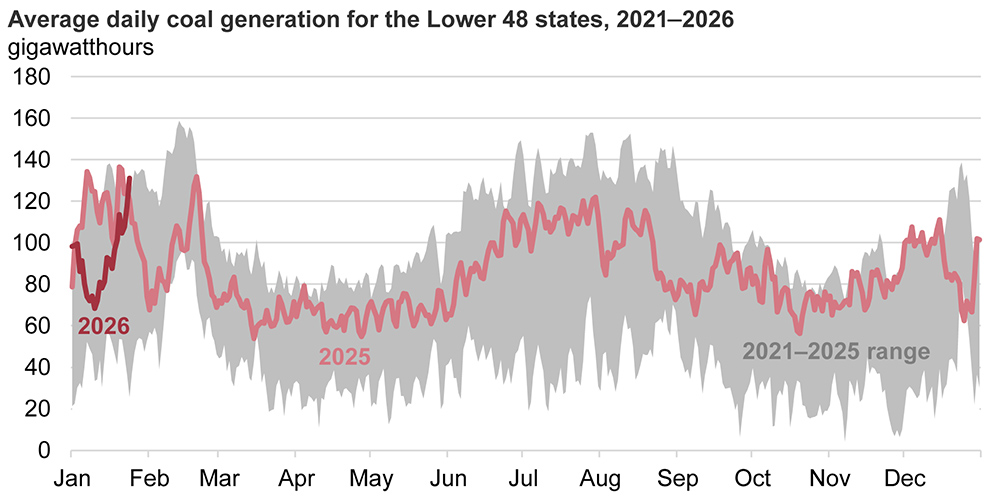

Electric bills have risen disproportionately in areas where power prices have risen most, or extreme weather events have forced larger-than-usual heating or cooling loads. Energy Information Administration data showed sharp increases in parts of California and New England since 2021.

What Goes Up Occasionally Comes Down

When I received a chipper email boasting that my electric rates had been cut, it was a pleasant surprise. “Dear PG&E Customer,” the email sent by Pacific Gas and Electric said, starting Jan. 1, “PG&E lowered electric prices — our fourth decrease in two years — to help make energy more affordable for the communities we serve.”

The near-term decline is counter to the national trend, as the company noted in a LinkedIn post: “The U.S. Energy Information Administration forecasts national electric prices to increase by nearly 10% between 2024 and 2026.” Small comfort, given that California residents face the second-highest power prices in the nation.

Less than a year earlier, a study by KQED found the average PG&E bill was up 70% since 2020. The customers’ pain didn’t stop the company, along with other California utilities, from trying to increase their authorized return to shareholders to 11.3%.

The request to increase investors’ ROE — the percentage of profit utilities may earn on shareholder-funded investments — was ill timed. It wasn’t just rejected, it was delivered with a slap on the wrist: The CPUC cut the rate, restricting PG&E, Southern California Gas Co. and San Diego Gas & Electric to a little under 10%, and Southern California Edison to a little over 10%, the lowest rate in 20 years.

The returns are not guaranteed. “The utilities earn the full authorized ROE only when they effectively manage costs, maintain safe operations, and deliver projects on time and on budget,” the CPUC said. A cost of capital mechanism enables automatic ROE adjustments when bond markets change substantially in either direction.

The rising prices aren’t about corporate and shareholder greed: They are a result of an aging system that’s being asked to meet conflicting demands. We need a larger grid that’s also more resilient. And if we are to deliver on a climate future that will let future generations flourish, it needs to be cleaner too, regardless of short-term political winds.

For grid operators, utilities and regulators, affordability is the challenge that complicates all those other demands.

Climate and Modernizations Drive Capital Needs

The drivers behind higher residential bills are layered and cumulative. Capital expenditures are surging, with utilities investing heavily in wildfire mitigation, storm hardening, undergrounding, modernizing the grid and replacing aging infrastructure.

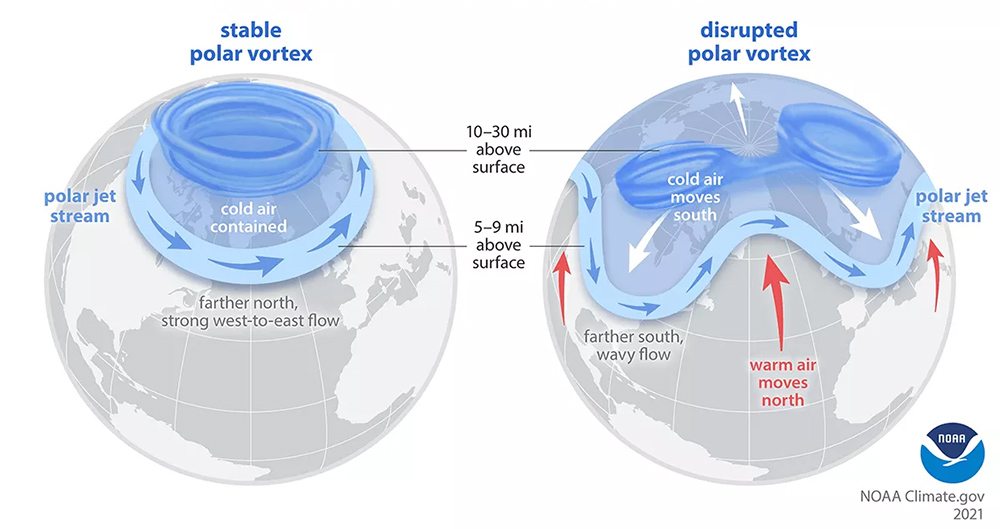

Climate stress is making those resilience investments unavoidable: NERC has repeatedly highlighted growing reliability risks tied to extreme weather and climate stress in its Long-Term Reliability Assessment.

The burden is compounded by the rising cost of money. Higher interest rates raise the cost of financing infrastructure, and those costs ultimately are reflected in rate base recovery.

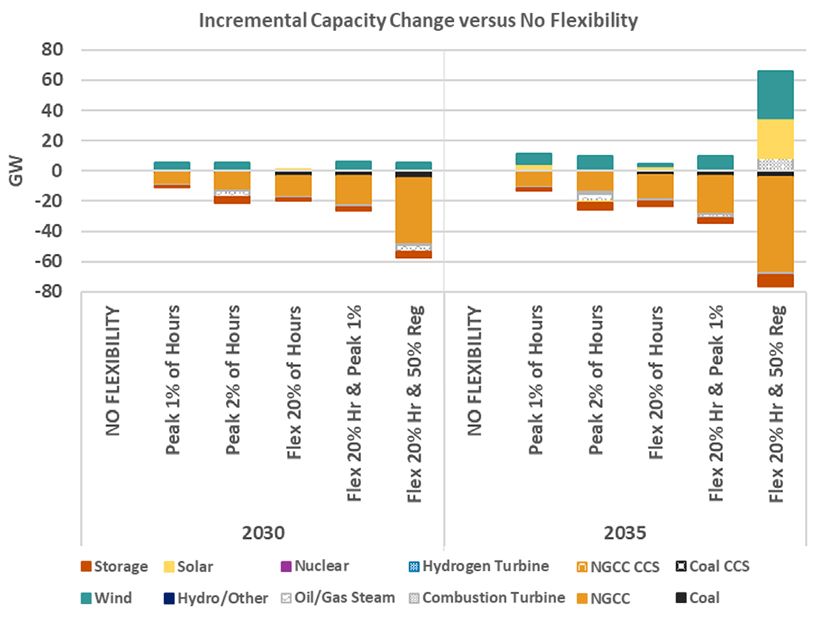

Data Centers Drive Rising Demand

After nearly two decades of flat demand in many regions, load growth has returned. And of the causes — electrification, EV adoption, building heating conversion and data center expansion — one bears the bulk of the perceived blame: data centers.

Total U.S. electricity use is forecast to grow by 1% in 2026 and 3% in 2027, according to the EIA. “This increase would mark the first time since 2007 that power demand has risen for four years in a row. The driving factor behind this surge is increasing demand from large computing centers.”

Greater load can support system use and spread fixed costs. But in the near term, it often requires incremental distribution upgrades and capacity investments that raise costs before efficiency gains materialize. (See DTE Treads Carefully as Michigan Becomes Flashpoint in Data Center Debate.)

EPRI’s Win-Win Watts position paper argued the increased demand from data centers doesn’t have to increase retail rates. “Proactive planning, robust safeguards in large-load tariffs and explicit incentives for demand flexibility, including initiatives like EPRI’s DCFlex, can help turn high-load-factor growth into a tool for moderating average prices, improving asset utilization and accelerating clean energy deployment.”

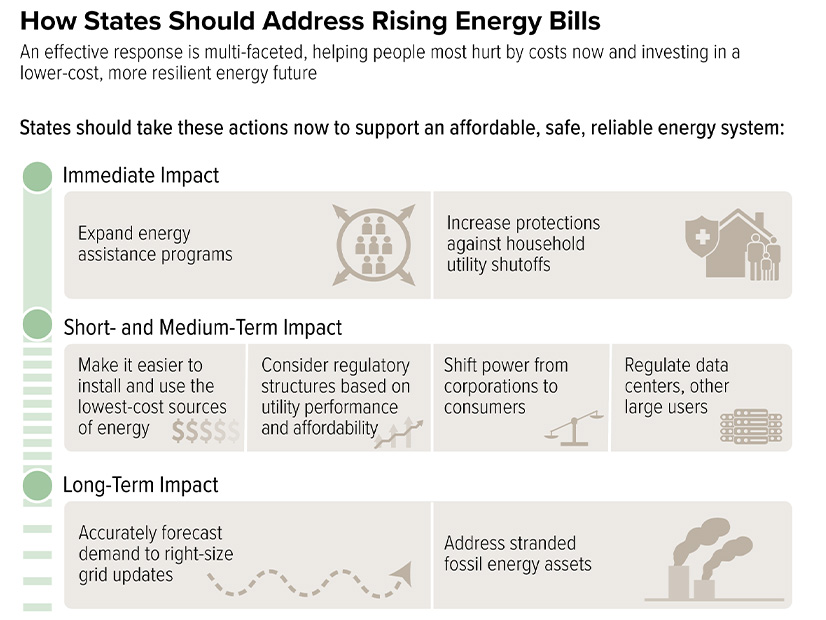

Addressing the Power Price Risk

The political harm caused by rising retail prices will be addressed, whether through political means, regulatory actions or utility efforts. Legislators are scrutinizing rate cases more aggressively, and if regulators and the industry won’t act, they will step in to fill the void. Some recent examples: Maryland Gov. Wes Moore (D) recently introduced the Lower Bills and Local Power Act, and Pennsylvania Gov. Josh Shapiro (D) urged PJM to protect consumers by extending the existing price floor and ceiling, the price collar, for the 2028/29 and 2029/30 capacity auctions.

For some politicians, a commitment to addressing constituents’ concerns about electricity bills is coming at a cost. Critics accuse New York Gov. Kathy Hochul (D) of ditching the state’s climate commitments to focus on the more politically urgent issue of energy costs.

Politicians do not always have to get involved. Some utilities and regulators are limiting price increases caused by rising data center demand from filtering down to household energy bills, Charles River’s study said. “Going forward, utilities and their state regulators have committed to protecting retail customers from rate increases caused by new data centers and are approving new tariffs and ratemaking measures that embed those protections.”

The Business Risk of Doing Nothing

Failure to address escalating energy costs will strain utilities’ balance sheets if bad debt rises as customers default or disconnect. Investor earnings calls reflect growing sensitivity to bill impacts and the need to balance capital deployment with moderation strategies.

Ratings agencies increasingly factor regulatory and political stability into utility outlooks. Moody’s and S&P regularly assess regulatory environments and affordability pressures in their utility sector commentary. The Center on Budget and Policy Priorities has outlined the risks of rising utility debt and the policy implications for states.

An Integrated Approach to Managing Energy Costs

For grid operators and utilities, the risk is that affordability becomes the weak link in the energy transition, not because resiliency, decarbonization and grid growth are not technically feasible but because those upgrades are not politically durable. There are four takeaways:

-

- Treat rate design as infrastructure policy: Providing transparency into use-based charges and fixed system recovery costs could improve public understanding. However, rates that better reflect system costs must be paired with consumer protections.

- Make affordability an important system metric: Incorporating explicit bill impact assessments into major capital approvals may help gain buy-in. Income-based assistance mechanisms may prove more durable than broad subsidies that dilute price signals.

- Revisit incentive structures: Implementing performance-based models that link utility performance to outcomes rather than capital deployment will build political capital over time.

- Acknowledge tradeoffs honestly: Building the grid of the future carries near-term costs, and customers deserve clear communication about why investments are necessary and how costs will be managed. It may not help them pay bills in the near term — something that’s also essential — but it may stabilize public trust.

Investing in Not-too-unhappy Customers

No one loves paying their power bill, especially in strained economic times, but rising prices are a reality as the grid transforms. The nation cannot afford to slow investment in transmission expansion, decarbonization or resilience, but public tolerance is a constraint as real as engineering requirements or capital access.

For utilities, grid operators and regulators, the message is straightforward: Affordability cannot be put on the back burner. The future of the grid depends on not only what gets built but also whether monthly bills make sense to the people paying them.