MISO said lackluster generating unit performance led to an emergency declaration during the late January winter storm.

The grid operator also dealt with its own technical issues during the storm that caused pricing glitches.

MISO declared a maximum generation emergency around 6 a.m. Jan. 24 for its Midwest region. It made emergency power purchases from PJM, used its member generators’ emergency ranges, sent instructions for members to make public appeals for conservation and called on load-modifying resources to meet demand. (See MISO Enters Max Gen Emergency in Arctic Blast.)

Ultimately, MISO’s 105.3-GW peak demand Jan. 27 during conservative operations was higher than Jan. 24’s approximately 96.4-GW crest.

“It’s become an annual event to see these deep, cold events push in,” Executive Director of System Operations J.T. Smith said during a Reliability Subcommittee meeting Feb. 17.

To submit a commentary on this topic, email forum@rtoinsider.com.

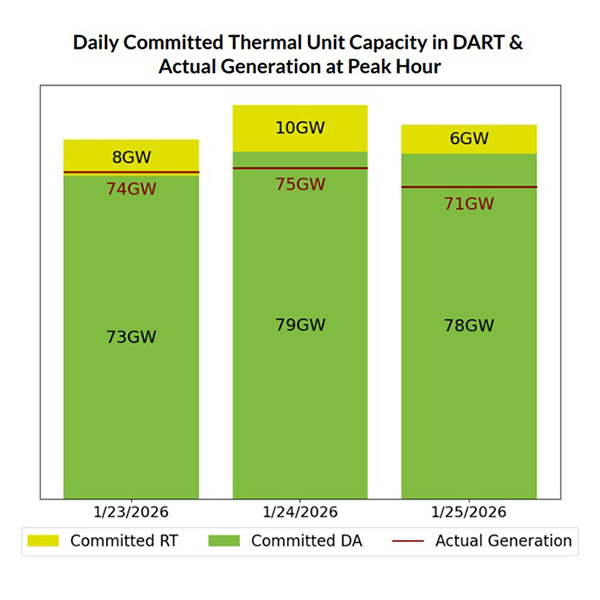

This time, Smith said thermal generators were “not living up to the offers they submitted” to MISO. Instead of resources tripping offline, they simply became unavailable. The RTO said that of the 79 GW committed in the day-ahead market and the additional 10 GW committed in real time, 75 GW in total generation showed up Jan. 24.

“From a reliability operations perspective, we need good, valid offers,” Smith said.

Smith said up until the evening of Jan. 23, “we were showing in our next-day plan to be fairly long.” That changed as MISO entered the operating day. It forecast “persistent negative capacity margins” for its Midwest region Jan. 24, forcing it to declare the emergency, Smith said.

Combustion turbines’ lead times “hindered real-time commitments,” Smith said. In MISO Midwest, 29 CTs extended their start times “significantly” Jan. 23. Of those, Smith said 13 made sure to stay under the RTO’s 24-hour lead time threshold to ensure they did not lose capacity accreditation value.

Smith said some of the resources modified their start-up times in real time. MISO staff said they are examining the 24-hour limit to see if it is too generous.

“Right now, a lot of folks are trying to mitigate their capacity accreditation impacts, and that’s understandable,” he said. “That is starting to become a problem in the winter that we’re going to have to have some conversations about.”

Smith also said when MISO asks its members to make sure offers are updated, that means for the next few days, not just the day of.

Of the 44 GW in total generation outages Jan. 24, MISO experienced 17 GW of unplanned outages. It also counted low wind production throughout the sustained cold Jan. 22-27, averaging slightly above 3 GW.

“During [Winter Storm] Fern, at one point, we got below a gigawatt of wind on either Jan. 23 or Jan. 24,” Smith said.

MISO reported that it exceeded its regional transfer limit by about 1,500 MW in the South-to-Midwest direction during the emergency. There is usually a 2,500-MW limit for South-to-Midwest flows.

“That is something that is not preferred for your contingency management,” Smith said, adding that MISO was able to work with the Tennessee Valley Authority, Southern Co. and other parties to the transfer agreement to secure extra space on the constraint.

MISO saw potential for a 5-GW deficiency on the morning peak Jan. 24. It secured 2 GW from available load-modifying resources and lined up 3 GW of emergency purchases from PJM. The RTO also called for members to appeal to the public, which was a “big deal,” Smith said.

Ahead of the evening peak, MISO again projected a 2- to 3-GW deficiency as solar lowered output and other generation ramped up to replace. Once again, MISO made the decision to make emergency purchases.

Smith said MISO was not certain if load-modifying resources would again spring into action after delivering reductions that morning. Under its tariff, MISO’s load-modifying resources are under no obligation to perform once they have already been called up in a day.

He said operators’ thinking was MISO was “only allowed to touch those resources once in a 24-hour period.”

“We did walk out of those emergency purchases pretty quick and were able to come out of the emergency declaration,” Smith said. As the next week began, and the cold moved from west to east, MISO was able to return the favor and export to the east, he said.

Pricing Malfunction

MISO’s internal systems hit a snag during the emergency.

The grid operator experienced software failures affecting its ex post pricing engine that prevented it from publishing its emergency prices for an 11-hour span Jan. 24. Because of that, MISO said prices did not reflect emergency conditions, and imports were not as incentivized as they would have been if the higher prices had been known. The RTO used a workaround to publish its real-time locational marginal pricing until Feb. 5, when it made a permanent fix.

The RTO said the imports it accepted from PJM were not motivated by pricing, but instead by its explicit request to purchase emergency power.

Multiple stakeholders asked MISO to analyze the impact that unpublished prices had on market behavior and share the results. They also asked about emergency pricing extending into MISO South on Jan. 24, when the region was not under emergency orders.

Smith said MISO would discuss pricing effects at upcoming Market Subcommittee meetings. It has yet to root out the cause of emergency pricing bleeding into MISO South, where no emergency was present.

‘Slow to Solve’

Smith also acknowledged that “the day-ahead markets were slow to solve” as weather moved in and complicated operations.

He said the day of the emergency, MISO’s systems struggled to manage about $870 million in market transactions. For comparison, “today, we cleared at $40 [million] to $50 million,” he said.

The complexity of added demand, pricing nodes and constraints taxed MISO’s computing power. “We might have to think about that. If the world is going to get more complex, we’re going to have to think about our market days,” Smith said, suggesting that the RTO may want to start clearing its day-ahead market earlier. “There is a computational issue that we need to think about overall.”

MISO’s slow-to-post day-ahead prices undoubtedly led to difficulties for market participants securing gas supplies.

Finally, Smith said MISO’s call for members to issue public appeals for conservation needs should be easier to understand.

“I don’t know if that is because it was 6 a.m. on a Saturday,” Smith said. “We’re going to have to do something to create a more clear outcome on this. … We got a ton of phone calls asking, ‘Are you really doing this, or not?’”

“This is significant to go to Step 2c,” said Jim Dauphinais, an attorney for multiple industrial customers, referring to the RTO’s emergency levels. “I believe that hasn’t happened in 17 years.”

At the height of the storm, MISO entered Step 2c, which is equivalent to NERC’s Level 2 Energy Emergency Alert. The next step would have entailed load shedding.

Dauphinais asked MISO to create a frequently asked questions document on the incident for stakeholders to review.

“It really comes down to the communications for WPPI,” said WPPI Energy’s Valy Goepfrich. Even though MISO claimed it was looking for emergency resources that could be deployed in two hours or less, the utility never received orders from the RTO, she said.

“We kept waiting for the scheduling instructions. It was really confusing,” she said.

MISO will go over its emergency actions again during its quarterly Board Week in late March in New Orleans. There, the Board of Directors will hear details and pose questions to RTO leadership.