PORTLAND, Ore. — Development of SPP’s Markets+ is in full swing. Financing has closed. Work teams and their governance structure have been assembled to implement the design. Various entities are registering for the market.

Further proof of the seriousness of the work ahead came with the new faces sprinkled among attendees for the first in-person Phase 2 meeting of the Markets+ Participant Executive Committee (MPEC). One committed participant sent its entire project team.

Jim Gonzalez, SPP’s director of seams and Western services, said the developments mark a sea change from a 2022 meeting in Phoenix where staff “pitched the idea” of offering market options in the Western Interconnection.

“That was really the first big stakeholder meeting SPP had with some interested parties in the West just describing what we thought we could do, how we’d like to work together to see if there was a way to create a day-ahead and real-time market for the West,” Gonzalez told RTO Insider after the Aug. 12 MPEC meeting. “Seeing the stakeholders really take ownership of their market and being comfortable making decisions has been really exciting to watch.

“It’s exciting for me thinking about not just the governance, but actually implementing the market itself, having the structure in place to be able to move forward to implement and make the necessary changes we need to as we work through that process,” he added.

Joe Taylor, with Xcel Energy’s Public Service Company of Colorado (PSCo), has seen market proposals in the West come and go, including a pair of SPP initiatives in the past decade. This one seems different, he said.

“[We] have a dedicated group of utilities, special interest groups, stakeholders,” he said. “It’s been funded. It’s a real market. We’re moving toward the end goal, and it gets a lot more serious and a lot more engagement as folks start to see what impact these decisions are going to have on what this market looks like.”

PSCo is one of five balancing authorities planning to be part of Markets+ when it goes live in October 2027, joining Arizona Public Service, Powerex, Salt River Project and Tucson Electric Power. The company received permission from the Colorado Public Utilities Commission to join Markets+ in July. (See Colo. PUC Approves PSCo’s Markets+ Participation.)

Pacific Northwest balancing authorities Bonneville Power Administration, Chelan County Public Utility District, Grant County PUD, Puget Sound Energy and Tacoma Power have deferred market participation until at least 2028. The PUDs and Tacoma Power are BPA preference customers dependent on the agency’s transmission system, as are many entities in the region.

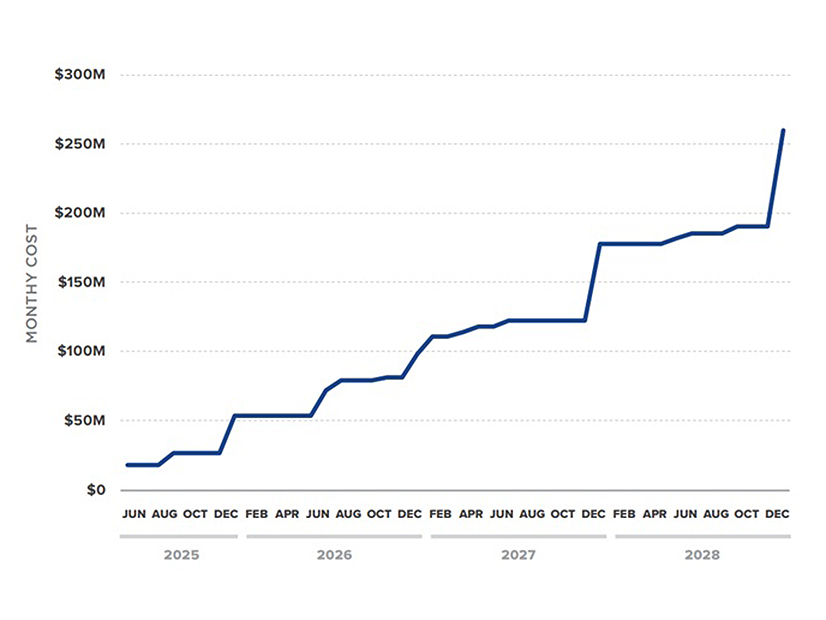

The utility BAs, with the exception of PSCo, have all made funding commitments to SPP. PSCo is waiting on an official order from the Colorado commission before agreeing to its portion of Phase 2’s $150 million cost.

Asked about the significance of PSCo joining Markets+, Taylor acknowledged its importance.

“We’re a fairly large utility with respect to this footprint, so I’m thrilled to be able to support my friends and colleagues throughout the West in their commitment,” he said.

Staff said 14 new entities have joined Markets+ during Phase 2, with two dropping out. That leaves 40 active in the phase, having registered— some several times — as various types, with 33 planning on being ready for go-live. The participant categories include:

-

- BAs or transmission service providers (5)

- Load-serving entities (9)

- Market participants (25)

- Stakeholders (29)

Participants have until Sept. 1 to register as a BA, Oct. 1 as a transmission service provider and Dec. 1 as a market participant.

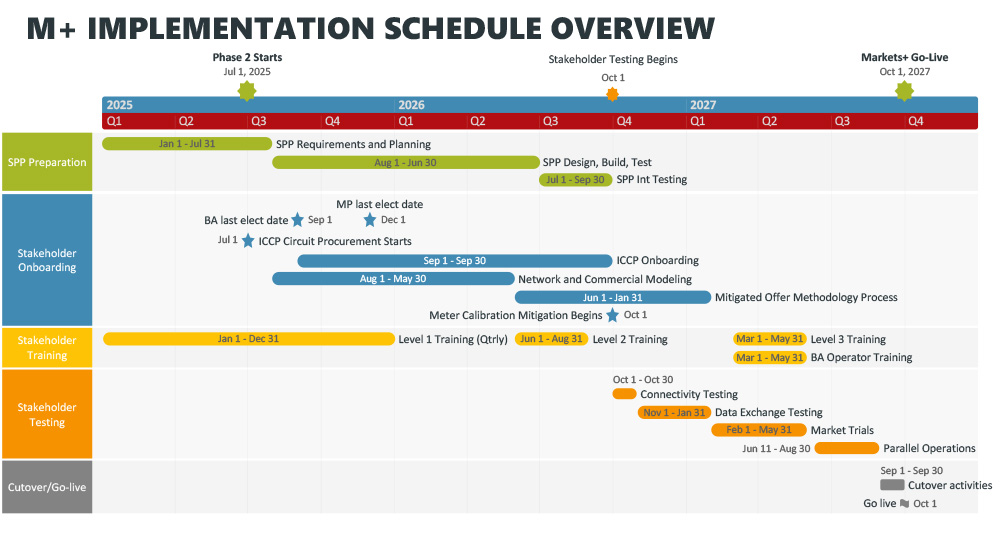

Network and commercial modeling has begun in the background. Connectivity testing, the first step before market trials, is scheduled to begin Oct. 1.

‘It All Takes Governance’

The meeting marked the official kickoff for the second phase’s governance. Based on the increased interest from Phase 2 participants, SPP said staff worked with MPEC and the Markets+ Interim Governance Task Force (MIGTF) to expand the task force from the current nine members to as many as 18. The scope change ensures an equal balance among investor-owned utility, public power and independent representatives, accommodating growth as the sector balance allows.

“It all takes governance to actually make this happen,” Gonzalez said.

The task force is responsible for reviewing and recommending changes to governance issues before they go to MPEC during Phase 2. It reports to the committee, along with working groups focused on transmission, market design, seams and reliable operations.

SPP staff will solicit MPEC representatives for public power nominees and send them to the full committee for approval of a balance roster before the next MIGTF meeting.

MPEC approved the rosters for the various working groups and task forces during the meeting, setting their limits at 21 or 24 people. Five of the groups include representation from the Markets+ State Committee (MSC), comprised of regulatory commissioners that are monitoring and providing input into the market’s development.

With several contested seats among the stakeholder bodies, SPP staff again will ask MPEC reps for nominees in underrepresented sectors. They will provide the committee with a list of nominees and bios for each stakeholder group; MPEC will vote on the nominees by email.

“It’s a good problem to have,” MPEC Chair Laura Trolese, with The Energy Authority, said in alluding to the lack of nominees during the first phase.

The committee approved all the roster expansions unanimously, with only four abstentions in all. In most cases, the current stakeholder chairs and vice chairs will continue in their roles until November. New leadership nominees will be placed when MPEC gathers in Tempe, Ariz., Nov. 12-13.

Following the meeting, most staff and stakeholders stayed for an in-person meeting of the Markets+ Change User Forum (MCUF). It will serve as a hub for coordinating participant efforts to implement process or system changes affecting market functions, particularly during market trials.

APS’ Elizabeth Goodman and Powerex’s Derek Russell were seated as the MCUF’s chair and vice chair, respectively.

SPP secured the $150 million Phase 2 funding agreement in June after receiving FERC approval of the tariff earlier in 2025. (See SPP Launches Markets+ Phase 2 With $150M Secured.)

MSC Funded for Phase 2

Arizona Commissioner Nick Myers, the MSC’s chair, told the MPEC that the commissioners have completed a memorandum of understanding with SPP that sets up a fund mechanism for Phase 2. The Western Interstate Energy Board (WIEB), a regulatory organization of 11 Western states and 2 Western Canadian provinces, supported the MSC during Phase 1.

“We’re funded,” Myers said. “WIEB has been supporting the MSC on [its] own since the inception of Markets+, so we’re glad to have that MOU in place. It further solidifies SPP’s support, and all of your support, for the MSC involvement in Markets+.”

Myers said the MSC will ask MPEC to direct the MIGTF to work with the regulators in investigating the election process for the Markets+ Independent Panel that eventually will oversee the market.

“There was a little disconnect there, and we just want to make sure that any holes might be plugged,” he said.