SPP’s Strategic Planning Committee unanimously endorsed RTO staff’s comprehensive approach to accelerate transmission capability, directing them and SPP’s working groups to prioritize the development of policies for all short-, mid- and long-term initiatives.

Time is running short, Casey Cathey, SPP vice president of engineering, said during the July 17 meeting. Staff are producing solutions for the 2025 Integrated Transmission Planning assessment, which will be shared with stakeholders in October.

The ITP portfolio is expected to be another large one, possibly double that of the record 2024 assessment. That one produced 89 projects expected to cost $7.65 billion. (See SPP Stakeholders Endorse Record $7.65B Tx Plan.)

“We still have some work to do to solidify and optimize that total final portfolio, but we’re still looking at a multibillion-dollar portfolio,” Cathey told the SPC. “It may be in the realm of $15 billion. And so there is a notion that anything that we can do between now and November, we should probably do, recognizing that expedited revision requests and all of the things moving so fast this year has been problematic.”

Noted teen philosopher Ferris Bueller said, “Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.”

But Cathey can’t afford to stop and look around.

“We have to accelerate everything. We need to accelerate load. We need to accelerate generation. And so today’s topic is accelerating all things transmission,” he said.

Cathey said while SPP has added about $1 billion in transmission annually over the last decade, the evolving generation mix and growing reliability needs demand a faster and more targeted response.

Staff have proposed a multiphase strategy that speeds up transmission capability by: accelerating issuance of notifications to construct and timelines for selecting transmission owners under the competitive process; increasing deployment of near-term solutions; improving the efficiency of project completions; and addressing a diverse range of stakeholder perspectives.

Gaining and obtaining the SPC’s endorsement and guidance was the first step.

Christy Walsh, with the Natural Resources Defense Council, said she loved the focus on capacity.

“We need to build more transmission. We need more. We need to upgrade the biggest existing system as much as we can,” she said. “We keep hearing it’s going to take three to five years to build transmission. But we’re also hearing we need capacity now for the new loads and whatnot. If we can squeeze more capacity out of the existing system … we should be doing that now while we’re waiting the optimistic three to five years for the new transmission, and that’s three to five years on top of the planning process.”

Cathey agreed, saying staff are evaluating internal procedural barriers and coordinating with state and federal agencies to streamline permitting and construction efforts. The upcoming work will incorporate the strategies into long-range planning efforts and potentially shape future policy proposals.

Forecasting Mitigation Process OK’d

The committee unanimously endorsed its Load Forecasting Task Force’s proposed strategy to mitigate forecast risk in the SPP footprint and its impact on system planning.

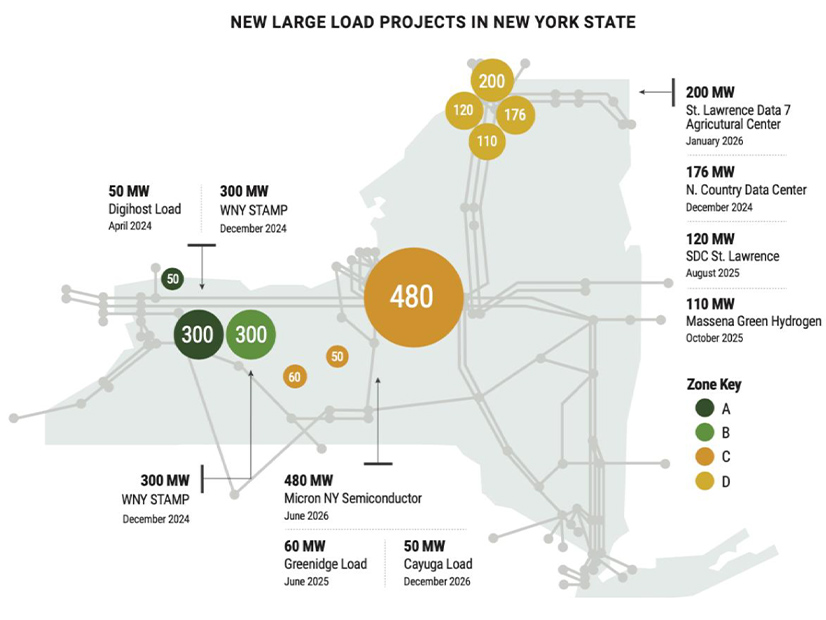

The team has proposed improving consistency between forecasts used for resource adequacy and transmission planning purposes to address growing concern about under-forecasting load due to rapid economic growth, electrification trends and data center expansions. It says traditional forecasting methods may not fully capture emerging demand risks.

Oklahoma Gas & Electric’s Brad Cochran, the task force’s chair, said the group has been meeting for a year. During that time, it had several conversations with other grid operators about their practices.

“What we were finding through discussions is there’s variability and timing of when entities are completing their forecasts and when they’re updating them,” he said. “We’ve talked extensively … about large loads and how fast they’re coming. Those forecasts change and those numbers change often, so aligning those two so you have similar information in both of these planning processes is a big deal.”

The team recommended continuing to use separate load-responsible entity forecasts for RA and Integrated Transmission Planning (ITP) but require an update to the ITP forecast during the RA submittal window. It also advocated that SPP assess whether to develop in-house forecasting expertise, but not conduct forecasts for individual LREs.

“Because of the diverse footprint of SPP and the diverse membership at this time, the task force didn’t think that it makes sense for SPP to develop these forecasts for all 60-plus LREs,” Cochran said.

He suggested SPP have some level of expertise and knowledge to give it “the ability to kind of build and evolve over time and look at these forecasts and communication.”

STRP Task Force Created

The SPC agreed to form a task force to help develop guidelines and a framework for reforming the process for considering short-term reliability projects (STRPs).

Irene Dimitry, an independent member of SPP’s Board of Directors, will chair the task force, which will report to the SPC. The effort comes after several attempts by staff resulted in a framework that she said was “too prescriptive.”

“Given our role as independent board members, we need the ability to each apply our own judgment in making decisions about what’s best for SPP and its members and all the customers that we serve,” she said.

SPP CEO Lanny Nickell said the focus for the task force should be, “How do we make it faster?” It has a January 2026 deadline for delivering meaningful plans to the SPC.

“Ultimately, we need to do whatever is needed to produce reliability upgrades, to produce economic value and optimize all of that to consumers in the region,” he said. “We just need to make sure we recognize the fact that speed is of the essence, particularly if there’s a reliability need that’s been addressed by any upgrade.”

SPP’s tariff defines STRPs as upgrades that meet the criteria for competitive projects but are needed in three years or less to address “identified reliability violations.” In that case, STRPs are not considered competitive upgrades under the tariff and are awarded to the incumbent transmission owner.

SPC Increases Membership

The Corporate Governance Committee approved 11 nominations to the SPC, raising the committee’s sector membership to match that of the 23-person Members Committee. The nominations result from an April change to the bylaws. The SPP board will vote on the nominations during its August meeting.

The new members are:

Nick Abraham, ITC Great Plains; Rebecca Atkins, Missouri Joint Municipal EUC; Jarred Cooley, SPS/Xcel Energy; Mark Foreman, Tenaska Power Services; Steve Gaw, Advanced Power Alliance; Christopher Matos, Google; Kevin Noblet, Kansas Electric Power Cooperative; Robert Pick, Nebraska Public Power District; Sarah Ruen, Tri-State Generation & Transmission; Emily Shuart, OG&E; Christy Walsh, Natural Resources Defense Council.

SPP has since announced Shuart will join SPP in September as senior director of external affairs and stakeholder relations. (See SPP Adds OG&E’s Shuart to External Affairs Leadership.)