When Gordon van Welie first started working for ISO-NE in 2000, the organization had about 300 employees, few formalized systems and processes in place, and a resource mix dominated by nuclear, coal and oil generation.

Now, 25 years later, as he prepares to retire from the organization, ISO-NE has roughly doubled in size and oversees a rapidly evolving grid set to serve as the backbone of an electrifying and decarbonizing economy. (See ISO-NE CEO Gordon van Welie Announces Retirement.)

“The organization I came into was very much still in startup mode,” said van Welie, who is the longest-serving head of any ISO or RTO in the country. “There was a lot of work that had to be done just to set up all the formality around an organization that’s going to clear, in some years, $20 billion.”

ISO-NE was created in 1997 to manage the region’s grid and power markets amid restructuring, and van Welie was brought in just a few years later, initially serving as the organization’s COO before his appointment as CEO in May 2001.

“I was very fortunate to be in at the early stages of the design and development of the wholesale market structure as we know it today,” van Welie said.

In the few years after van Welie took over as CEO, ISO-NE developed and launched its day-ahead and real-time markets and navigated a potential three-way merger with PJM and NYISO. The merger, which was explored in response to FERC’s interest in expanded ISO footprints, ultimately was abandoned due to the challenges of reconciling the differences between regions, van Welie noted.

He also oversaw ISO-NE’s transition to becoming an RTO in 2005, after FERC incentivized transmission owners to join RTOs across the country. This transition, and the negotiations that surrounded it, led to NEPOOL turning over filing rights for market rules to ISO-NE and codified ISO-NE’s responsibility for transmission planning in New England.

“The next big adventure,” van Welie said, was the creation of the region’s forward capacity market, which led to a “major settlement proceeding down in Washington, D.C.”

ISO-NE eventually ran its first forward capacity auction in 2008 for the 2010/11 capacity commitment period. The auction has been through 18 auction cycles, and the RTO in the midst of a major overhaul of the market intended to prepare the region for anticipated demand and supply changes associated with decarbonization efforts.

The Rise of Gas Generation

ISO-NE’s resource mix has experienced a dramatic shift during van Welie’s time with the RTO. As the fracking boom caused gas prices to plummet, the competitive wholesale markets helped speed the transition from oil and coal to gas generation, van Welie said.

In 2000, natural gas accounted for just 15% of generation in the region, while oil and coal accounted for a combined 40% of generation. By 2012, gas resources were responsible for 52% of generation, while oil and coal resources combined to account for about 4% of generation. Gas increased to about 55% of generation in the region by 2024. (See New England Gas Generation Hit a Record High in 2024.)

Following restructuring, “there were billions upon billions of dollars invested in the region in generation assets,” van Welie said. “That, I think, would not have occurred as quickly as it occurred without the establishment of wholesale markets.”

The introduction of wholesale markets also has helped protect consumers from poor investments during this period, van Welie said. He highlighted Dominion Energy’s decision to spend nearly a billion dollars to refurbish the Brayton Point coal plant, only for the plant to become uneconomic in just a few years because of the rise in low-cost fracked gas. The plant retired in 2017.

“That was a billion-dollar investment made by private capital that New England ratepayers never incurred,” van Welie said. “It was not a good investment, and ultimately, wholesale market structure shielded consumers from those investments.”

Transmission Investments

The gas generation boom was aided by the agreement in the early 2000s on a transmission cost allocation framework to regionally share the costs of reliability projects expected to bring system-wide financial benefits, van Welie said.

This helped enable major investments in transmission infrastructure, which increased transmission rates but reduced congestion costs and the need for reliability must-run contracts to retain retiring resources. These investments made it easier for new gas plants to come online, speeding up the turnover of the fleet, van Welie said.

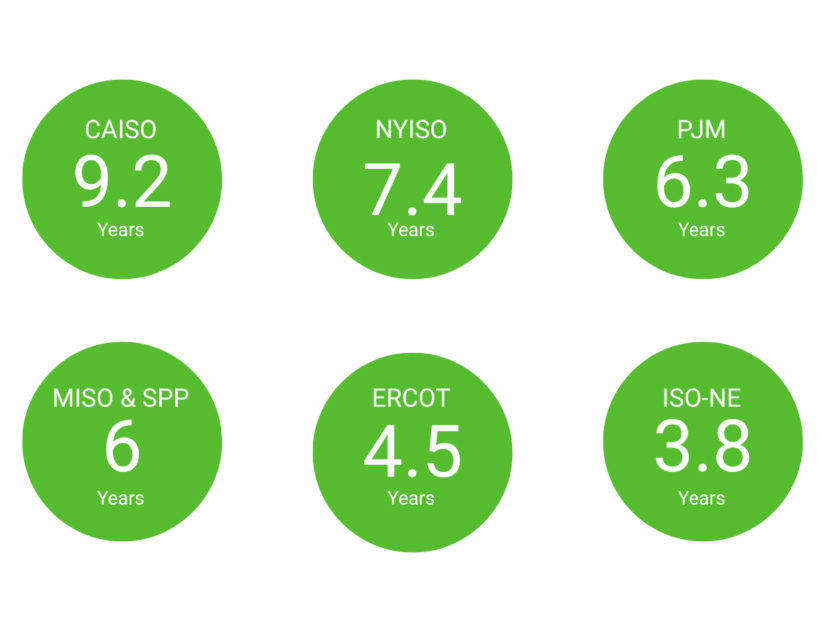

Today, New England has the lowest congestion costs of any RTO, coupled with transmission rates that are “more than double the average rates in other RTO markets,” according to Potomac Economics. (See NEPOOL PC Briefs: June 24-26, 2025.)

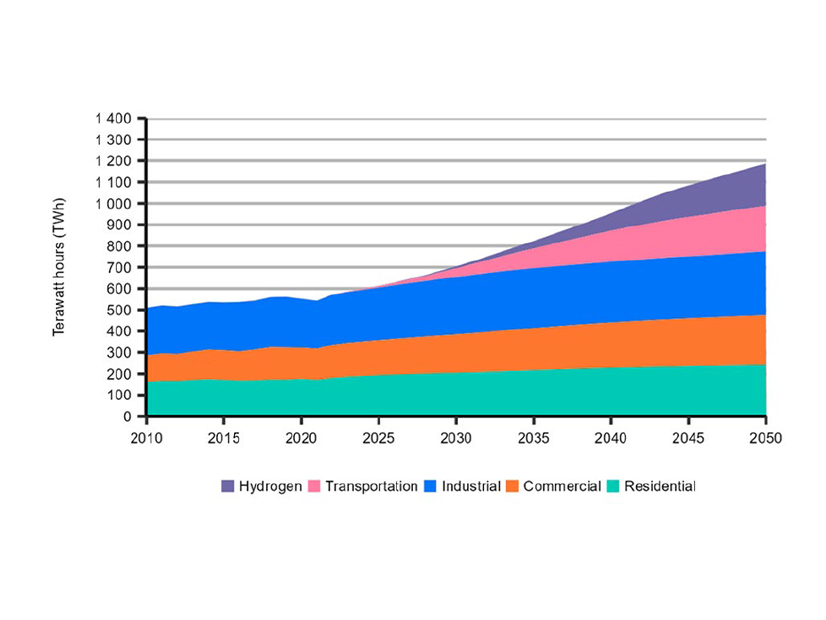

The transmission investments made during this period also have helped New England prepare for accelerating load growth and a growing influx of renewable energy, van Welie said. The RTO forecasted in its 2050 Transmission Study that the region likely will need to spend an additional $22 billion to $26 billion to meet load growth associated with heating and transportation electrification. (See ISO-NE Prices Transmission Upgrades Needed by 2050: up to $26B.)

“I think we made that investment at exactly the right time,” he said, noting that the cost of new transmission infrastructure has increased rapidly in recent years.

“We laid a foundation at a time when transmission was … inexpensive relative to today,” he said. “If you look at where we are today, we’ve got a very strong transmission system. It’s well positioned to support the next stage of growth.”

Resource Adequacy and Energy Transition

He said he’s confident ISO-NE has adequate resources to meet load and ensure reliability through 2030 but acknowledged there are valid questions about how to ensure resource adequacy in the 2030s and beyond.

“I’m confident the ISO is going to do what it needs to do,” he said, pointing to the ongoing capacity market overhaul as a “foundational ingredient to maintaining the successful trajectory we’ve had over the last 25 years.”

However, ISO-NE cannot succeed on its own, and will need “a supportive regulatory environment for markets to be successful,” van Welie added, emphasizing the need for support from both federal and state regulators and policymakers.

“If we have people pulling in opposite directions … it’s going to make it that much harder for investors to have confidence in the market construct,” he said.

Reiterating his testimony from the recent FERC technical conference on resource adequacy, van Welie said policymakers should work to reduce barriers to entry for new resources. He stressed that the wholesale market “rests on the premise that you can price the prevailing supply and demand conditions and produce a price signal that will attract the investment.” (See FERC Dives into Thorny Resource Adequacy Issues at Tech Conference.)

But whatever challenges lay ahead for ISO-NE, van Welie will be off the hook come Jan. 1, 2026, when longtime COO Vamsi Chadalavada is set to take over at the organization’s helm.

“I definitely will miss the ISO,” van Welie said, adding that he is looking forward to spending more time with family. “I would like to stay involved in the industry in some way. So that’s a new chapter in my life that I’m thinking through.”