As decarbonization policy and the growth of intermittent renewable power in New England drives increasing needs for clean balancing resources, a developer in Maine is evaluating whether pumped storage hydropower — one of the oldest generation technologies still used in the region — could play an increased role in the grid of the future.

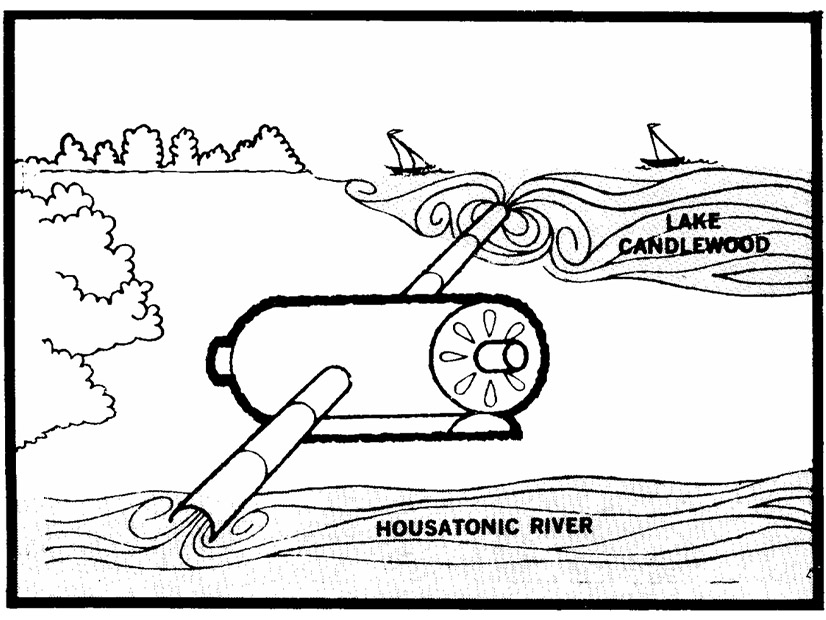

The history of pumped storage dates back about 100 years in New England. The Rocky River facility, which remains in operation today in western Connecticut, was the first of its kind in the U.S. when it came online in 1929. It was built to help balance the variable production profile of run-of-river hydropower.

The facility is based on a simple concept: During periods of low-cost power, two 3.5-MW reversible pump turbines push water from the river to a large reservoir at a higher elevation. When power demand peaks, water flows downhill to produce power through the two turbines and a larger conventional generator.

In the 1960s and 1970s, the proliferation of nuclear power in New England spurred the development of two significantly larger pumped storage facilities in Western Massachusetts.

Northfield Mountain, which has 1,168 MW of qualified capacity with ISO-NE, and the Bear Swamp Generating Station, which has 662 MW of capacity, were built by utilities to help match the production profile of the nuclear resources with demand, allowing the nuclear plants to stay online at a constant level. The pumped storage facilities charged during low-demand periods at night and discharged during peak load periods in the day.

The facilities are open-loop systems, pumping water from rivers to elevated reservoirs. They use large reversible pump turbines that are about 30% less efficient when pumping water uphill than when generating.

In the 50 years since the two plants came online, all but two nuclear plants in New England have been decommissioned, but Northfield Mountain and Bear Swamp remain in service.

“The economics of the projects really haven’t changed. You’re still looking for that price arbitrage: We’re going to try to pump when prices are low, and we’re going to turn around and generate when prices are higher,” said Justin Trudell, CEO of FirstLight Power, which owns and operates the Rocky River and Northfield Mountain facilities. Trudell previously worked at Brookfield Renewable, which co-owns Bear Swamp.

To recover the costs of pumping water, “you’ve got to at least make up that 30-ish-percent loss of efficiency in that price arbitrage; that would set your baseline,” Trudell said.

He added that, over the past decade, the steady increase of solar generation has caused the typical temporal pattern of pumping and discharging to shift.

“On sunny days, especially in the summer, we’re seeing deep troughs in pricing midday when you have this glut of solar online,” Trudell said. “We’re seeing a lot more opportunities now where we’re actually pumping during the day, and we’re generally generating during the evening peak.”

Growing behind-the-meter solar generation has contributed to an increasing difference between midday and evening demand. The RTO recorded a record-low demand around 2 p.m. on Easter Sunday in April, and about two months later, it recorded its highest load in over a decade around 7 p.m. on June 24. (See Growth of BTM Solar Drives Record-low Demand in ISO-NE and Extreme Heat Triggers Capacity Deficiency in New England.)

New Development Possibilities

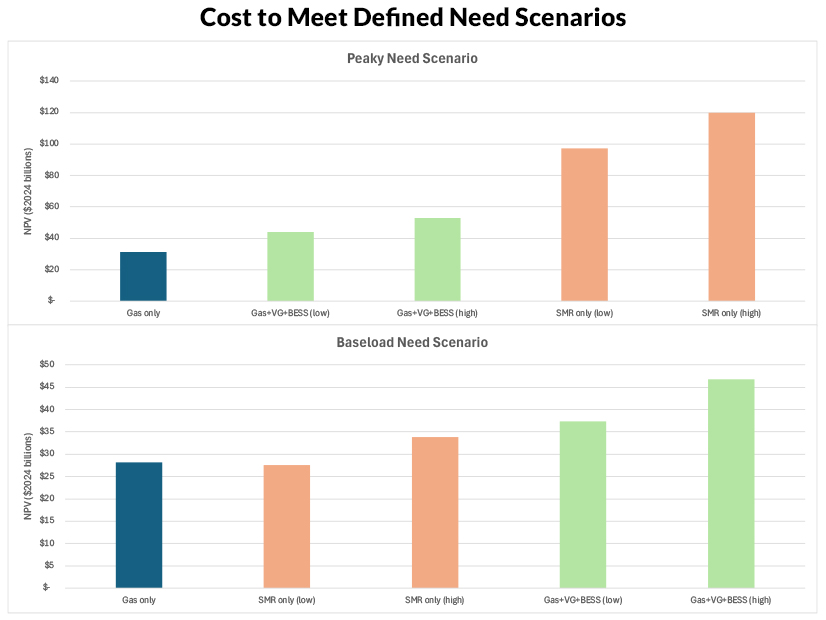

With the growth of intermittent renewables poised to continue in New England because of clean energy policies, increasing power demand and the challenges of fossil development in the region, states are looking to procure significant amounts of new storage capacity.

Connecticut has set a goal of deploying 1,000 MW of storage by 2030, while Massachusetts in 2024 passed legislation aiming to procure 5,000 MW of energy storage by mid-2030, broken into mid-duration, long-duration and multiday categories.

Western Maine Energy Storage, a company backed by construction corporation Cianbro, is investigating whether new pumped storage facilities could help meet this storage need, and in July it submitted a preliminary permit application for a 400- to 500-MW project in Dixfield (P-15410).

The proposed reservoir system effectively would function as a closed-loop system, featuring two 100-acre reservoirs at different elevations.

This design may help the project avoid some of the environmental challenges associated with open-loop pumped storage facilities connected to river systems. Northfield Mountain and Bear Swamp are involved in extended relicensing proceedings with FERC and have drawn criticism and opposition from environmental groups over impacts on downstream ecosystems.

Western Maine spokesperson Tom Brennan said the project is enhanced by the increasing arbitrage opportunities brought by renewable production in the region. He highlighted Maine’s goal of achieving 100% clean power by 2040.

“If we’re going to do that, we’re going to need storage,” Brennan said.

He said the company has been evaluating potential sites for a pumped storage project “for many years,” adding that “Maine is, in many ways, ideal because of the topography variation.”

“It’s because of that topographic variation and access to a significant and appropriate transmission line that has us focused in on Dixfield,” he said.

Unique Characteristics

Compared to lithium-ion batteries, pumped storage resources typically have a longer duration, though they rarely discharge to the point of depletion. Northfield Mountain has a duration of nearly eight hours, while Bear Swamp has a duration of about 4.5 hours.

Both facilities also tout their ability to ramp up from no output to full output within about 10 minutes.

“We’re faster[-ramping] than gas, and we’re longer-duration than most batteries,” FirstLight’s Trudell said. “We’re in this sweet spot of being able to provide more of a service for a longer period of time than some of these other technologies.”

Trudell said Northfield Mountain relies primarily on revenues from the ISO-NE wholesale markets and often is held in reserve by the RTO as a first contingency. He emphasized the reliability benefits of the facility’s ability to quickly ramp up or down as needed.

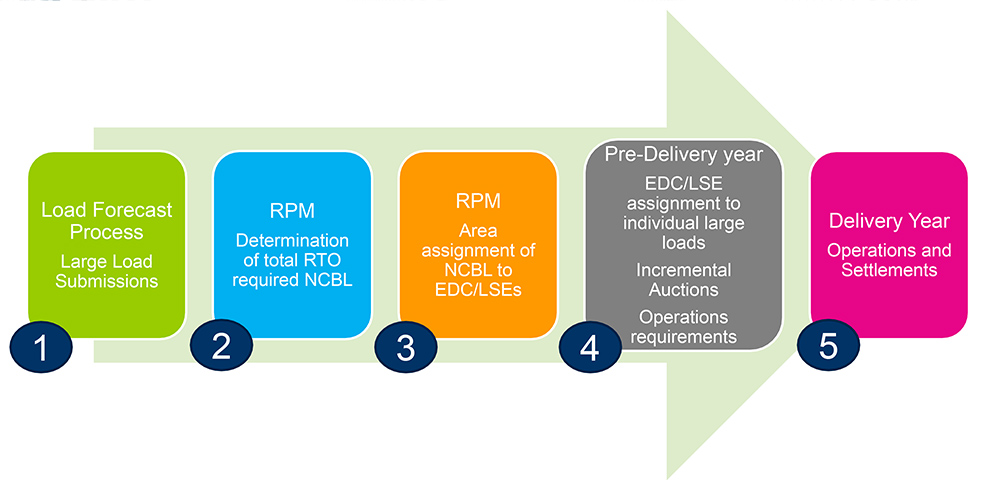

As ISO-NE works to overhaul its methodology for accrediting resources in its capacity market, storage owners have pushed for the RTO to account for ramp-up time in its accreditation methodology, and the storage industry is closely following the accreditation project to see how the changes could affect future capacity market revenues. (See ISO-NE Kicks off Talks on Accreditation, Seasonal Capacity Changes.)

State revenues generally are not a major revenue source for existing pumped storage resources; while Massachusetts’ Clean Peak Energy Standard does not exclude pumped storage resources from generating Clean Peak Energy Certificates, resources that came online prior to 2019 are not eligible. Bear Swamp, which underwent an upgrade after this deadline, has qualified about 88 MW of its capacity in the program.

In July, Massachusetts issued a procurement of 1,500 MW of mid-duration storage, seeking to buy environmental attributes including Clean Peak certificates. (See Massachusetts Seeks 1,500 MW of Mid-duration Energy Storage.) Bear Swamp bid its full 88 MW of Clean Peak-qualified capacity for the procurement on Sept. 10.

‘Who’s Going to Buy the Power?’

By nature, pumped storage projects are capital intensive, and any new facility likely would need a significant amount of revenue certainty for investors to commit to a project.

“The question is offtake, and you’ve got to get offtake before you get financing,” Trudell said. “We know how to license, from the federal side, a new pumped storage project. The problem is: Who’s going to buy the power?”

Connor Nelson, manager of regulatory affairs and markets at the National Hydropower Association, noted there has been no new pumped storage built in the U.S. in about 30 years, in part because of these barriers.

“What you have is a long-lead-time, capital-intensive resource,” Nelson said. “You need patient capital, patient investment, and you need, in a lot of cases, some sort of long-term capacity contract or a strong market signal that can assure developers and investors that this is going to be worth it in the long run.”

However, he stressed that there is an “ever increasing need for long-duration energy storage” and that the “prospects for pumped hydro are as good as they’ve ever been, in part because there’s a lot of good federal incentives right now.”

He noted that the recent federal reconciliation bill did not strip incentives for pumped storage resources, and developers that begin construction by 2033 could get “upwards of 30% of that investment back in the form of a tax credit or direct pay if you’re a utility.”

Western Maine’s Brennan declined to comment on the type of contracts or revenue certainty the company would need to move forward on the Dixfield project.

“We are so early in the process,” Brennan said. “I am very short on details at this point; the design details will be in the works for some time to come.”