By Doug Sheridan

While pundits wrangle over the implications of the One Big Beautiful Bill Act for America’s power sector, Texas has managed to blow itself a renewable‐energy bubble — one spawning so much solar and wind energy that the kind of generation it actually needs sits on the drawing board.

The culprit? A mix of federal incentives and state policies that turned the state’s grid into a speculative sandbox for developers chasing subsidies rather than serving actual energy demand.

In recent years, ERCOT has enjoyed a reputation for fast interconnections and friendly regulatory treatments for new generation. This has spurred the rush by renewables developers to use the system to monetize federal investment tax credits (ITCs) for their projects before tax codes change.

Current law affords investors in qualifying projects a tax credit equal to 30% of the original cost of the project. In reality, the tax breaks are even larger. According to Neil Booth of Orbis Consulting, under current IRS guidance, project developers may immediately “step up” the value of a project’s equipment to a higher value on the basis that the economic value of the equipment is higher once connected to the grid.

This accounting maneuver and other add-ons mean tax-equity investors can recoup 100% of their investment as soon as 90 days after a project goes live. It doesn’t take a genius to understand how such a siren call of quick returns can incentivize investors to target the one grid on which they can get their projects online as fast as possible — irrespective of whether that grid needs the incremental intermittent power.

Companies like Meta, Microsoft, Amazon and Google add their own distortions. These hyperscalers sign long-term power-purchase agreements (PPAs) with renewables developers to help brand themselves as “green” operators. On its face, this makes it seem like corporate America is doing its part to decarbonize. In practice, it’s not clear how many hyperscalers are in fact consuming the electrons for which they have contracted.

Instead, hyperscalers may simply pay for the renewable power per the PPA, then sell it back into ERCOT’s wholesale market. This affords their operations the environmental seal of approval they seek, even though their facilities might be running on gas-fired generation in other states. Meanwhile, the intermittent power from the renewables is being dumped onto the Texas grid without a stable, long-term customer — undermining both supply and demand fundamentals, as well as prices for the dispatchable power needed to balance the system.

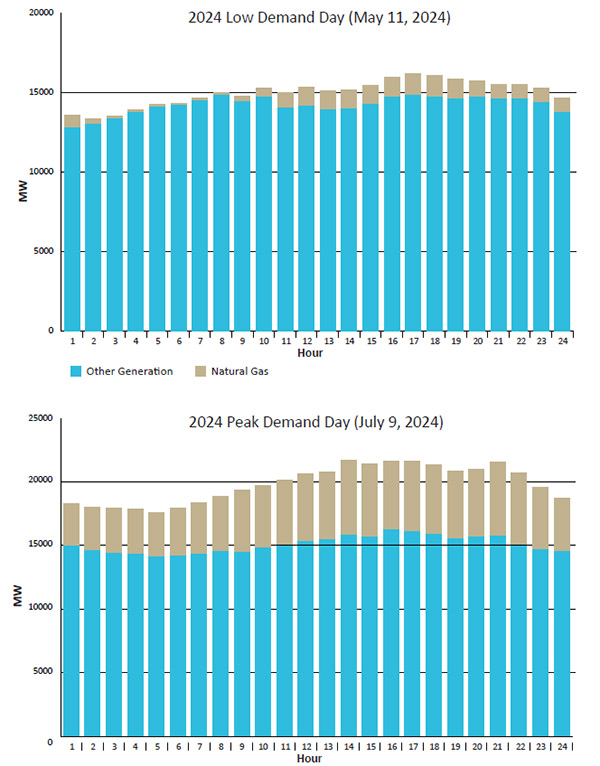

The EIA reports that Texas added a net 29.2 GW of supply from 2022 to 2024. Subsidized solar, wind and battery capacity represented 97.9% of this. More capacity has since been added, and ERCOT now reports 86.8 GW of renewables on its system — for a grid with an all-time demand peak of less than 90 GW.

NERC has taken note, pegging ERCOT’s on-peak reserve margin at more than 40%. In a rational market, this would slam the brakes on further buildout of renewables. Instead, ERCOT’s interconnection queue shows 374 GW of new renewable and battery projects interested in connecting to the system—more than 10 times all other resource types combined.

Meanwhile, despite leading the nation in natural gas production, Texas has seen developer interest in newbuild gas-fired generation nearly vanish. The problem is developers can’t pencil out viable projects when first-in-line solar, wind and batteries crush revenue expectations.

As a result, the new combined-cycle and peaking plants needed to keep the grid stable during peak hours and weather lulls and to back up renewables are effectively locked out of the Texas market. This has left ERCOT’s administrators with little choice but to continue connecting more part-time renewables.

Texas’ booming population, rising EV adoption and prospective surge in on-grid data center demand all point to the need for more dependable, around-the clock generation. Instead, the state is hardwiring increasing amounts of intermittent energy — and the operational costs and complexities that come with it — into its grid. What’s more, over 40% of its nuclear, coal and gas-fired capacity is 30 years old or older. Aging infrastructure and falling revenues can lead to delayed maintenance and lower investment, putting reliability at risk.

Unless Texas policymakers change course, the consequences of swelling market distortions will become harder to manage. A grid saturated with financially engineered, subsidy-seeking projects won’t in the long run deliver stable prices or dependable service. Without serious reform, Texas faces a future of inflated rates, reliability challenges and growing dependence on taxpayer-funded interventions.

It’s time to restore the integrity of ERCOT’s wholesale power market and re-center its grid planning around the kind of dispatchable power that can deliver when Texans need it. Otherwise, this renewables bubble won’t just pop. It will burst — with the state’s energy security caught in the fallout.

Doug Sheridan is President of EnergyPoint Research in Houston, Texas.