RTO Insider

AESOCAISO/WEIMCAISO Board of GovernorsCalifornia Agencies & LegislatureCalifornia Air Resources Board (CARB)California Energy Commission (CEC)California LegislatureCalifornia Public Utilities Commission (CPUC)EDAMOther CAISO CommitteesWestern Energy Imbalance Market (WEIM)WEIM Governing BodyCompany NewsERCOTERCOT Board of DirectorsERCOT Other CommitteesERCOT Technical Advisory Committee (TAC)Public Utility Commission of Texas (PUCT)FERC & FederalIESOIESO Strategic Advisory CommitteeIESO Technical PanelISO-NEISO-NE Consumer Liaison GroupISO-NE Planning Advisory CommitteeNEPOOL Markets CommitteeNEPOOL Participants CommitteeNEPOOL Reliability CommitteeNEPOOL Transmission CommitteeMarketsAncillary ServicesCapacity MarketEnergy MarketReservesVirtual TransactionsMISOMISO Advisory Committee (AC)MISO Board of DirectorsMISO Market Subcommittee (MSC)MISO Planning Advisory Committee (PAC)MISO Regulatory Organizations & CommitteesOrganization of MISO States (OMS)MISO Reliability Subcommittee (RSC)MISO Resource Adequacy Subcommittee (RASC)NYISONY PSCNYISO Business Issues CommitteeNYISO Management CommitteeNYISO Operating CommitteeOther NYISO CommitteesPJMPJM Board of ManagersPJM Market Implementation Committee (MIC)PJM Markets and Reliability Committee (MRC)PJM Members Committee (MC)PJM Operating Committee (OC)PJM Other Committees & TaskforcesPJM Planning Committee (PC)PJM Transmission Expansion Advisory Committee (TEAC)Public PolicyEnvironmental RegulationsReliabilityState & RegionalAlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareDistrict of ColumbiaFloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyLouisianaMaineManitobaMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOntarioOregonPennsylvaniaRhode IslandRTO-IndianaSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyomingResourcesDemand ResponseDistributed Energy Resources (DER)Energy EfficiencyEnergy StorageBattery Electric StorageOther Electric StorageGenerationCoalGeothermalHydrogenHydropowerNatural GasNuclear PowerOffshore WindOnshore WindOperating ReservesRooftop/distributed SolarUtility-scale SolarResource AdequacySpecial Reports & CommentaryCommentaryConference CoverageOther CoverageSpecial ReportsSPPMarkets+Other SPP CommitteesSPP Board of Directors & Members CommitteeSPP Markets and Operations Policy CommitteeSPP Regional State CommitteeSPP Seams Advisory GroupSPP Strategic Planning CommitteeWestern Energy Imbalance Service (WEIS)SPP/WEISTransmissionFinancial Transmission Rights (FTR)Transmission OperationsTransmission PlanningTransmission Rates

New England experienced record high energy costs in the month of January amid cold weather, high gas prices and a heavy reliance on oil-fired generation.

CAISO wants to ensure grid reliability when artificial intelligence data centers “pulsate.”

Xcel Energy says that a partnership with NextEra Energy will allow its operating companies to contract up to 6 GW of data center capacity by the end of 2027.

John Hairston will retire from his position as head of the Bonneville Power Administration, stepping away after 35 years of working at the federal power agency.

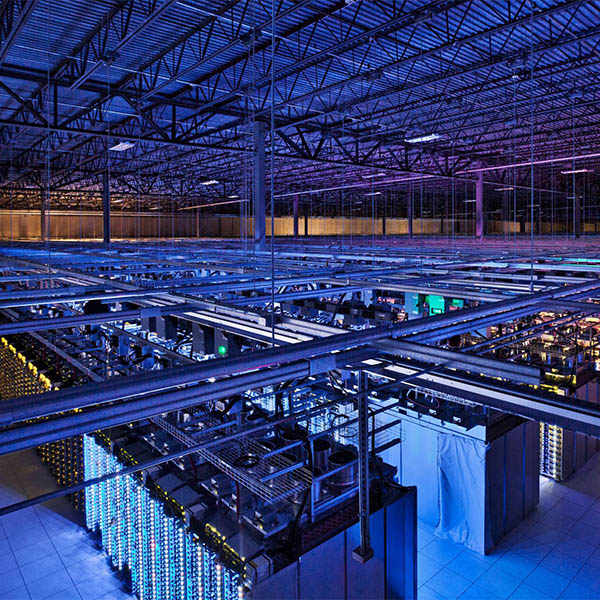

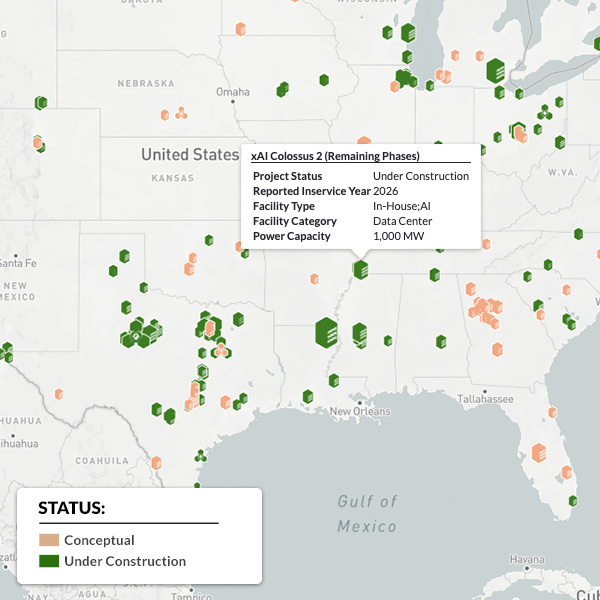

Cleanview released a report putting numbers to a trend where many hyperscale data center developers are building dirtier, more quickly available generation to cash in on the AI boom.

EPRI, InfraPartners, NVIDIA and Prologis will assess ways data centers in the 5- to 20-MW range can be built quickly at or near utility substations that have available capacity.

A federal order to keep Unit 1 of the coal-fired Craig Generating Station operational past its planned retirement date seems disconnected from grid realities, a Colorado state energy official said.

CAISO leaders staged a virtual “town hall” to stress the importance of a smooth rollout to the ISO’s Extended Day-Ahead Market in May and promise to address market seams issues.

Work on the $7.5 billion, 810-MW project off the New York coast has been halted twice by the administration and resumed twice by the Norwegian developer.

SPP says ample wind generation during the January winter storm enabled it to export as much as 3,500 MW to its neighbors in the Eastern Interconnection.

Want more? Advanced Search